MUMBAI: Indian government bonds continued their winning run, ending the day higher on Tuesday after stronger-than-expected demand for state debt sale lifted sentiment, while benign U.S. Treasury yields and surplus liquidity conditions added to the positive backdrop.

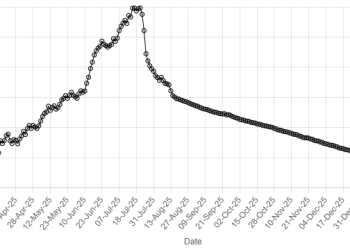

The benchmark 6.48% 2035 bond yield ended at 6.66%, after closing at 6.6642% on Monday. The yield has declined by about 11 basis points over the last six sessions.

“After heavy selling in January, the yield curve has now stabilised as Reserve Bank of India has ensured adequate liquidity through various tools, bringing overnight levels lower and thereby creating demand,” said Prashant Pimple, fixed income CIO at Baroda BNP Mutual Fund.

Indian states raised 394.50 billion rupees ($4.35 billion) through sale of debt, higher than their planned quantum of issuance, at cutoff yields that were below market estimates for the second straight week.

State bond yields had risen over the last few weeks on supply pressure, but have been declining this month after the central bank’s comfort with easier liquidity.

India’s banking system liquidity surplus has averaged around 2.70 trillion rupees a day in February, comfortably over 1% of bank system deposits.

U.S. Treasury yields meanwhile extended their fall on Tuesday, with the 10-year yield dropping to 4.03% from 4.0560% in Asian hours, after retail inflation slowed in January contributing to greater bets for rate cuts later this year.

Rates

India’s shorter-duration overnight index swap (OIS) rates were barely changed, while the long-end witnessed marginal paying interest after hitting a key level.

The one-year OIS rate ended at 5.505%, while the two-year rate closed at 5.615%. The five-year OIS rate settled at 6.0425%.