MUMBAI: Indian government bonds fell on Tuesday, as traders booked profits after last week’s rally that was triggered by easing fiscal concerns.

The yield on the 10-year benchmark bond settled at 6.4942%, compared with Friday’s close of 6.4651%. It fell 13 basis points last week. The market was shut on Monday.

Bond market appetite revived last week after a smaller-than-expected revenue loss from the government’s consumption tax cuts and Finance Minister Nirmala Sitharaman’s remarks assuaged fears of fiscal slippage and heavier debt supply.

“There was a resistance near 6.43%-6.44% levels (on the 10-year bond yield)… after which some profit booking kicked in,” said Gopal Tripathi, head of treasury and capital markets at Jana Small Finance Bank.

Sitharaman told local media on Monday that the government will leave its borrowing calendar unchanged, and is confident to meet the fiscal year’s deficit target.

However, state bonds continued to see pressure, with a debt sale on Tuesday seeing states borrowing less than planned with several top lenders staying on the sidelines as they near internal limits for such investments.

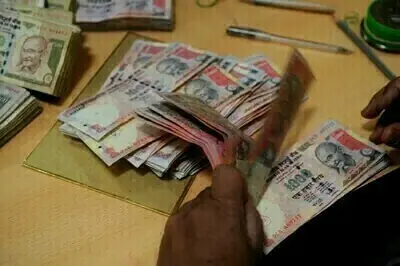

Indian states raised 149 billion rupees ($1.69 billion) via bonds on Tuesday, below the targeted 153 billion rupees.

Investors await key India and U.S. inflation data due later this week.

India’s inflation likely rose to 2.1% in August, from 1.55% in July with the “base effect” fading and food prices rising, according to a Reuters poll.

Rates

India’s overnight index swap rates fell tracking lower US Treasury yields.

Traders expect this downside to be capped till the RBI gives a signal on further rate easing, traders said.

The one-year OIS rate was slightly down at 5.48%, while the two-year OIS rate settled little changed at 5.45%.

The five-year OIS rate ended 1 bp lower at 5.7025%.