MUMBAI: India needs to be cautious towards stablecoins, as they pose significant macroeconomic risk while serving no purpose that fiat money cannot, the Reserve Bank of India Deputy Governor, T. Rabi Sankar, said on Friday.

Stablecoins gained global prominence after the U.S. passed a law to create a regulatory framework for dollar-pegged cryptocurrency tokens, boosting their popularity and pushing the global market cap of such tokens above $300 billion.

India has diverged from large global and regional economies, including Japan and the European Union, in framing laws around cryptocurrencies, fearing that bringing the digital assets into its mainstream financial system could raise systemic risks.

“Beyond the facilitation of illicit payments and circumvention of capital measures, stablecoins raise significant concerns for monetary stability, fiscal policy, banking intermediation, and systemic resilience,” Sankar said in a speech in Mumbai.

“Stablecoins do not serve any purpose fiat money cannot,” he said.

Such tokens are yet to establish the benefits their proponents claim and remain inferior to fiat money, he said, adding India will continue to approach these innovations with caution.

India central bank eases restrictions on cash credit accounts, eases current account norms

REGULATING CRYPTO

At present, crypto exchanges can operate in India after registering locally with a government agency tasked with due diligence to check money laundering risks. Taxes are imposed on gains from cryptocurrencies.

Despite the regulatory caution, crypto trading has gained popularity in India, with crypto exchanges pointing to increased participation from users outside major urban centres.

“Cryptocurrencies have no intrinsic value. Since they do not have any underlying cash flows, they are not financial assets as well,” Sankar said in his speech, in which he argued in favour of central bank digital currencies. “CBDCs are inherently superior to stablecoins,” Sankar said.

India is currently running a retail and wholsesale pilot for its central bank digital currency, which has about 7 million users.

When asked why the central bank and the government do not bar trading in cryptocurrencies altogether, Sankar said that the views of different stakeholders need to be taken into account.

“It is under consideration and (a decision) will be taken. We have to all finalise our approaches and actions based on what that decision is,” he said.

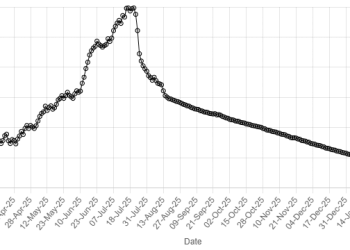

American Dollar Exchange Rate

American Dollar Exchange Rate