NEW DELHI: The Indian government has reduced the proportion of ultra-long bonds in its fiscal second half borrowing plan after suggestions across investor segments, shifting some borrowing to shorter duration papers.

The government will raise 6.77 trillion rupees ($76.32 billion) through market borrowings during the October to March period, 50 billion rupees lower than its previously announced schedule in an effort to tame rising bond yields and ensure market stability.

India had planned to raise 14.82 trillion rupees in the current financial year through March, and sold bonds worth 7.95 trillion rupees in April-September. The second half borrrowing plan reduces overall issuance slated for this fiscal to 14.72 trillion rupees.

Based on wider consultation with the central bank and market feedback, the share of long tenor securities has been reduced and the total borrowing for the year is now a shade lower than the initial estimates, economic affairs secretary Anuradha Thakur said.

India bonds in tight rope before second-half supply calendar

“I would like to reemphasize that the government is committed to meeting the fiscal deficit target,” Thakur said.

The government has reduced the share of ultra-long bonds which mature in 30 years, 40 years and 50 years to 29.5% in the second half, down from 35% in first half.

The five-year and 10-year bonds will bear the brunt with an increase of 2 and 2.2 percentage point share respectively, while three-year bonds will see issuance go up by 1.3 percentage points.

Traders have said the liquid portion up to the 10-year part of the yield curve could witness selling pressure on Monday, while long duration papers could see some buying interest.

The 10-year bond could be the worst impacted as the government has raised its auction size to 320 billion rupees, even as traders had suggested cutting down the size.

“We have already seen the breach of 6.52% today, and there would be further upside on Monday,” said a senior trader with a private bank, adding “We could see 6.55%-6.56% as well.”

Despite cancelling an auction of green bonds in the first half, the government will sell green bonds worth 100 billion rupees in October-March.

Earlier this month Finance Minister Nirmala Sitharaman said “unsustainably” high bond yields are making government borrowing unaffordable when interest rates are otherwise low.

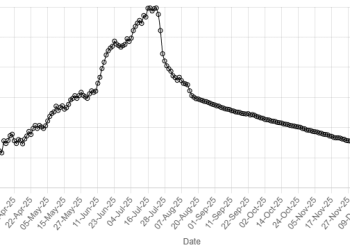

India’s 10-year benchmark bond yield closed at 6.5231% on Friday.