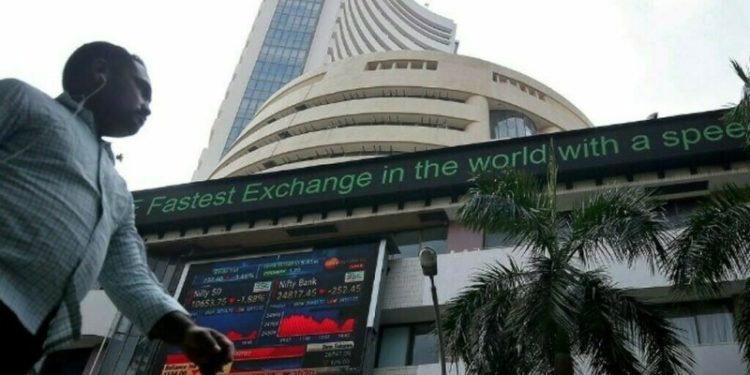

India’s benchmark indexes are set for a muted open on Tuesday, as investors adopt a cautious stance following U.S. President Donald Trump’s call to evacuate Tehran amid escalating Israel-Iran tensions.

The Gift Nifty futures were trading at 24,960 as of 8:02 a.m. IST, indicating that the Nifty 50 will open near Monday’s close of 24,946.5.

U.S. stock futures slipped and oil prices rose on Tuesday, as the fifth day of Israel-Iran fighting heightened fears of a broader regional conflict.

India’s equity benchmarks snap two-day losing streak

Trump cut short his attendance at the Group of Seven summit in Canada, citing mounting tensions in the Middle East. He also reiterated that Iran should have agreed to a nuclear deal with the United States.

India’s equity benchmarks rebounded in the previous session, lifted by gains in heavyweight IT and financial stocks, even as geopolitical worries lingered.

Foreign portfolio investors (FPI) remained net sellers of Indian shares for the fourth straight session on Monday, with outflows amounting to 25.39 billion rupees ($295.9 million).

Domestic institutional investors continued to be net buyers for the 20th straight session.

“Evolving geopolitical developments and oil price trends will be key drivers for domestic equities in the near term,” said Satish Chandra Aluri, analyst at Lemonn Markets Desk.

India’s benchmark indexes are set for a muted open on Tuesday, as investors adopt a cautious stance following U.S. President Donald Trump’s call to evacuate Tehran amid escalating Israel-Iran tensions.

The Gift Nifty futures were trading at 24,960 as of 8:02 a.m. IST, indicating that the Nifty 50 will open near Monday’s close of 24,946.5.

U.S. stock futures slipped and oil prices rose on Tuesday, as the fifth day of Israel-Iran fighting heightened fears of a broader regional conflict.

India’s equity benchmarks snap two-day losing streak

Trump cut short his attendance at the Group of Seven summit in Canada, citing mounting tensions in the Middle East. He also reiterated that Iran should have agreed to a nuclear deal with the United States.

India’s equity benchmarks rebounded in the previous session, lifted by gains in heavyweight IT and financial stocks, even as geopolitical worries lingered.

Foreign portfolio investors (FPI) remained net sellers of Indian shares for the fourth straight session on Monday, with outflows amounting to 25.39 billion rupees ($295.9 million).

Domestic institutional investors continued to be net buyers for the 20th straight session.

“Evolving geopolitical developments and oil price trends will be key drivers for domestic equities in the near term,” said Satish Chandra Aluri, analyst at Lemonn Markets Desk.