NEW DELHI: India plans to retain a cap on voting rights for large shareholders in domestic banks, two sources said, signalling that New Delhi’s attempts to liberalise the financial sector and draw more foreign investment will remain limited in scope.

Reserve Bank of India (RBI), the country’s banking regulator, has initiated a number of steps to unwind complex regulations in recent months and has permitted foreign lenders to pick up large stakes in domestic banks.

The government is also planning to more than double the foreign-investment cap in state-owned lenders to 49%, Reuters reported last week.

However, rules for voting rights will not be eased yet, the sources said.

CONCERNS REMAIN ABOUT EXCESSIVE CONTROL

As per current rules, a single shareholder cannot hold more than 26% voting rights in a private bank, even if their ownership is higher than that. For government-owned banks, that cap is 10%.

India’s federal finance ministry and RBI discussed increasing the cap on voting rights to give large shareholders more say in strategic decisions but decided against it to avoid excessive control, said the first source.

India’s central bank proposes changes to credit risk rules for lenders

The Indian government wants certain safeguards like a cap on voting rights of 26% for a single shareholder to remain in place to avoid sole decision-making, said the first source.

The sources declined to be identified as discussions are private. India’s finance ministry and the RBI did not immediately respond to Reuters’ emails seeking comments.

CAP COULD ACT AS DETERRENT TO INVESTMENT

The plan to keep a cap on voting rights could act as a deterrent for large investors to pick-up controlling stakes in Indian banks at a time when foreign interest is high.

India has seen two rare cross-border banking transactions this year, including Dubai-based Emirates NBD’s purchase of a 60% stake in RBL Bank and Japan’s Sumitomo Mitsui Banking Corp’s investment in YES Bank.

The government is also seeking a majority investor in state-owned IDBI Bank expecting to conclude that process by end of March 2026.

There is keen interest by foreign investors in India’s banks, both sources said. If investors decide to reduce their holdings, their stakes can be snapped up by others, said the second source, signalling confidence that the retention of voting limits will not cause problems.

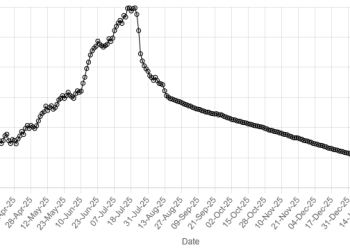

American Dollar Exchange Rate

American Dollar Exchange Rate