MUMBAI/LONDON: Indian mills have signed export contracts for around 180,000 metric tons of sugar this season with a domestic price correction and weaker rupee belatedly driving overseas sales in recent weeks, trade and industry officials told Reuters.

The federal government in November approved exports of 1.5 million tons of sugar from the current season, which opened on October 1. But high prices on the local market have led to sluggish export activity.

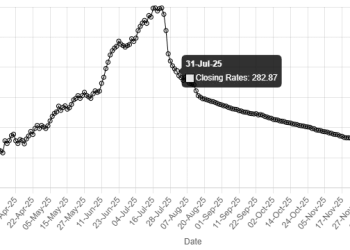

That slower-than-expected pace of shipments from India, the world’s second-largest sugar producer, could support global prices, which are trading near their lowest levels in five years.

Five dealers told Reuters that mills have so far contracted shipments to Afghanistan, Sri Lanka and East African countries. All the sources declined to be named, because they were not authorised to speak publicly on the matter.

“Mills used to get better prices from exports than from the domestic market. This time, there’s no real incentive to export,” said a Mumbai-based dealer with a global trade house.

“Still, some mills are stepping forward because they need cash to pay farmers for cane.”

India’s sugar export quota at risk as mills avoid low-priced global market

BUMPER PRODUCTION BRINGS DOWN LOCAL PRICES

Local prices had been holding above global benchmarks.

They have only corrected in the past three months, slipping 6% to 36,125 rupees ($401.35) per ton as supplies from the new season began arriving. Output reached 11.9 million tons from October to December, a 25% increase on the previous year.

Indian sugar is now being offered at around $450 per ton on a free-on-board (FOB) basis, or nearly $20 per ton above benchmark London futures, the dealers said.

“Supply pressure has brought down local prices. Exports are not profitable at current price levels, but they are no longer loss-making as they were last month,” said B.B. Thombare, president of the West Indian Sugar Mills Association.

India has only a narrow export window in the January-to-March quarter, said one New Delhi-based dealer with a trade house, as shipments from top producer Brazil are expected to undercut prices from April.