MUMBAI: Indian government bond yields ended marginally higher for the week on Friday, as elevated oil prices dampened sentiment, overshadowing dovish commentary from the central bank chief.

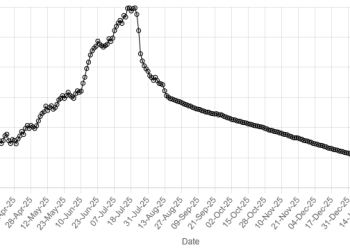

The yield on the benchmark 10-year bond ended at 6.3087%, compared with the previous close of 6.3095%. The five-year 6.75% 2029 bond ended at xx% after ending at 6.0176% on Thursday. The yields rose 1 and 2 basis points this week.

“The immediate lookout in the market is the ongoing Iran- Israel conflict and its impact on oil prices and the currency,” said Rahul Bhuskute, CIO at Bharti AXA Life Insurance.

“If the conflict escalates further and the oil price shoots up sharply, the central bank may find itself in a spot to protect the rupee and may have limited room to ease more.”

The benchmark Brent crude contract has risen 4.2% so far this week, after jumping 11.7% last week amid ongoing conflict between Iran and Israel.

The contract was around $77 per barrel, with uncertainty about potential U.S. involvement stoking caution.

Indian bond yields marginally higher; focus on oil, debt supply

India imports a bulk of its crude oil needs, and higher prices could impact its inflation outlook.

Earlier this month, the Reserve Bank of India reduced its inflation forecast for the current fiscal year to 3.7%, while cutting its key lending rate by a steeper-than-expected 50 basis points.

It, however, reverted to a “neutral” stance from “accommodative”, prompting analysts to forecast the end of the monetary easing cycle.

However, RBI Governor Sanjay Malhotra said earlier in the week that inflation below the central bank’s current projections could open up policy space.

Rates

Indian overnight index swap (OIS) rates eased slightly this week, after witnessing paying in the previous week.

The one-year OIS rate was at 5.52%, while the two-year OIS rate ended at 5.52%. The liquid five-year ended at 5.75%.

American Dollar Exchange Rate

American Dollar Exchange Rate