MUMBAI: The Indian rupee is expected to be under pressure at the open on Friday, weighed down by a broad risk-off mood and weakness across Asian currencies.

The limited impact of the central bank’s intervention further sours the currency’s immediate outlook, bankers said.

The 1-month non-deliverable forward indicated the rupee will open in the 90.68-90.70 range versus the US dollar, having settled 0.12% higher at 90.59 on Thursday.

Despite what bankers said was an unexpected pre-market intervention by the Reserve Bank of India aimed at lifting the currency, the rupee managed only a marginal uptick on Thursday.

While the central bank’s dollar sales triggered an initial rally at the open, the move quickly ran into resistance. Importers used the recovery to add fresh hedges, while traders said the broader bias to buy dollars on dips remained.

The lack of follow-through after the intervention-led spike only reinforces the prevailing market belief that downside in dollar/rupee is limited from current levels, a currency trader at a bank said.

“With that in mind and yesterday’s forceful RBI move, interbank desks are likely to look to trade the 90.00–91.00 range, buying dips toward the lower side.”

Risk aversion, dollar strength

U.S. equities tumbled on Thursday, led by a pullback in technology shares, setting off a negative lead for Asia. The shift in sentiment revived popular risk-off trades

The dollar rose on safe-haven demand, and U.S. Treasuries rallied. The 10-year U.S. yield slid and is now trading below levels seen prior to the robust U.S. jobs data release, unwinding the post-payrolls spike.

While lower U.S. Treasury yields are typically supportive of the rupee and other emerging-market currencies, declines driven by risk aversion tend to blunt that benefit.

The rally in U.S. Treasuries was supported by a modest upside surprise in weekly initial jobless claims.

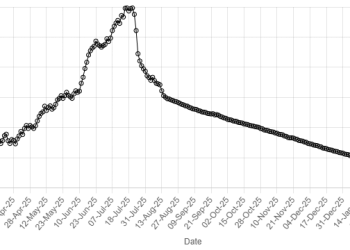

American Dollar Exchange Rate

American Dollar Exchange Rate