MUMBAI: Indian investors are set for another supply overhang as state governments and central government owned entities have lined up heavy debt sales on a single day.

States and state-run firms look to raise an aggregate of 492 billion rupees ($5.49 billion) on Tuesday, at a time when the market is struggling to digest even the central government securities.

“The domestic market is seeing higher supply from PSU companies and state governments causing a demand supply mismatch,” said Nikhil Aggarwal, founder & group CEO at Grip Invest, an online bond trading platform.

“Investors will demand higher yields to have a cushion to compensate for liquidity risk caused due to demand supply imbalance and an uncertainty about RBI policy stance.”

States are aiming to raise more than 332 billion rupees, 25% higher than the planned calendar, while Power Finance Corp is eyeing 60 billion rupees and Bank of India plans to raise 100 billion rupees through infrastructure bonds.

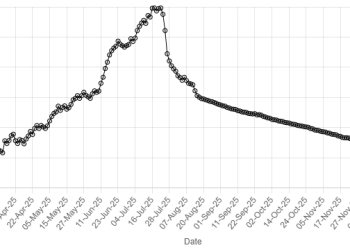

Yields across fixed income assets have jumped since the Reserve Bank of India cut its policy repo rate on December 5, as most investors bet the rate easing cycle is now completed.

The 10-year benchmark bond yield is up by over 20 bps from the lows of December 5, while state and AAA-rated corporate bond yields have jumped 20-25 bps.

Indian rupee ends flat, wedged between importer dollar demand and firmer Asia FX

“The softness in investor demand has been led by pensions and insurance, which has impacted demand for ultra-long bonds,” said Gaura Sen Gupta, chief economist at IDFC First Bank.

Market focus is shifting to supply-demand imbalance expected in the next financial year, where “there is a sharp rise in redemptions for both government securities and state government bonds which would keep gross supply on the higher side,” as fresh issuances hit the market.

Investors across categories from private-sector banks to mutual funds are also moving to lower duration exposure, further jeopardising appetite for long papers.