Pakistan’s headline inflation clocked in at 7.2% on a year-on-year basis in October 2024, slightly higher than the reading in September 2024 when it stood at 6.9%, showed Pakistan Bureau of Statistics (PBS) data on Friday.

On a month-on-month basis, CPI increased by 1.2% in October 2024 as compared to a decrease of 0.5% in the previous month and an increase of 1% in October 2023.

CPI inflation average during 4MFY25 stood at 8.68% as compared to 28.45% in 4MFY24.

The reading in October is also marginally higher than official expectations.

The finance ministry in its monthly outlook released on Wednesday stated that it expects inflation to stay within the range of 6-7% in October and decelerate further to 5.5-6.5% by November.

“It is expected that inflation will remain within range of 6-7% in October and further down to 5.5 – 6.5% by November 2024,” the Ministry of Finance said in its ‘Monthly Economic Update and Outlook’.

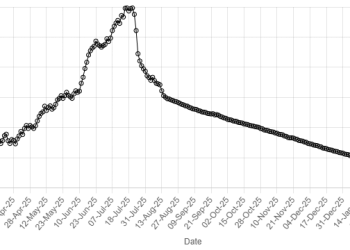

Inflation in Pakistan has been a significant and persistent economic challenge, particularly in recent years. In May of last year, the CPI inflation rate hit a record high of 38%. However, it has been on a downward trajectory since then.

The declining inflation trajectory also gives impetus to a further cut in the key policy rate.

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) is scheduled to be held on Monday, November 04.

In its last MPC held in September, the SBP unleashed its most aggressive cut in the key policy rate since April 2020, reducing it by 200bps to bring it down to 17.5% amid slowing inflation and declining international oil prices.

Meanwhile, the latest CPI reading was also slightly higher than the projections made by a number of brokerage houses.

Topline Securities expected inflation reading to clock in at around 6.5-7.0% in October.

“Pakistan’s Consumer Price Index (CPI) for Oct 2024 is expected to clock in at 6.5-7.0% YoY (+0.9% MoM), taking 4MF25 average to 8.6% compared to 28.5% in 4MFY24,” said the brokerage house.

Meanwhile, JS Global projected CPI to fall to 6.5% in October.

“Ongoing sharp disinflation trend is expected to persist, with October 2024 CPI likely to fall to 6.5% (lowest since Jan-2021 owing to a high base affect), a 59bp MoM uptick. This would take 4MFY25 average to 8.5%, down from 4MFY24 average of 28.4%,” JS Global said.

Urban, rural inflation

The PBS said CPI inflation urban remained stable at 9.3% on year on-year basis in October 2024 as compared to the previous month and increase of 25.5% in October 2023.

On month-on-month basis, it increased by 1.1% in October 2024 as compared to a decrease of 0.5% in the previous month and an increase of 1.1% in October 2023.

CPI inflation rural increased by 4.2% on year-on-year basis in October 2024 as compared to 3.6% in the previous month and 28.7% in October 2023.

On month-on-month basis, it increased by 1.5% in October 2024 as compared to a decrease of 0.5% in the previous month and an increase of 0.9% in October 2023.

American Dollar Exchange Rate

American Dollar Exchange Rate