The Pakistani rupee remained largely unchanged against the US dollar during the opening hours of trading in the inter-bank market on Monday.

At 10:15am, the rupee was hovering at 278.32, a gain of Re0.01 against the greenback.

During the previous week, the rupee decreased marginally as it lost Re0.12 or 0.04% against the US dollar. The local unit closed at 278.33, against 278.21 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

In recent weeks, the domestic currency has largely been around 277-278 against the dollar as Pakistan moves forward with its plan to win a longer and longer International Monetary Fund (IMF) bailout programme.

Internationally, the currency market started the week cautiously, with the dollar slightly lower on Monday after data last week showed US inflation had stabilised in April, keeping the door open for the Federal Reserve to cut interest rates later in the year.

The dollar posted its first monthly decline of the year in May, weighed down by shifting expectations on when the US central bank will cut rates and by how much.

Markets are pricing in 37 basis points of cuts this year from the Fed after data on Friday showed the personal consumption expenditures (PCE) price index increased 0.3% last month, matching the unrevised gain in March.

The dollar index, which measures the US currency against six rivals, was 0.067% lower at 104.51 on Monday.

Oil prices, a key indicator of currency parity, were little changed on Monday, as investors weighed a move by producer group OPEC+ to extend deep output cuts well into 2025.

Brent futures for August delivery were down 4 cents, or 0.05%, to $81.07 a barrel at 0344 GMT, after falling to a session low of $80.55.

US West Texas Intermediate (WTI) crude futures for July delivery slipped 1 cent, or 0.01%, to $76.98, after falling to $76.39 earlier.

Brent settled down 0.6% and WTI posted a 1% loss last week.

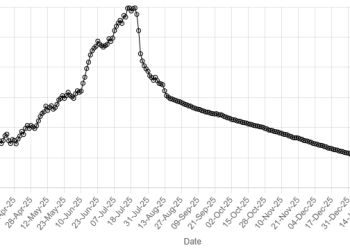

American Dollar Exchange Rate

American Dollar Exchange Rate