The Pakistani rupee remained largely stable against the US dollar, appreciating 0.01% during the opening hours of trading in the inter-bank market on Tuesday.

At 10:20am, the local unit was hovering around 278.33, a gain of Re0.04 against the greenback.

On Monday, the rupee had closed at 278.37 after a loss of Re0.09.

In recent weeks, the domestic currency has largely been around 277-279 against the dollar as Pakistan moves forward with its plan to win a longer and longer International Monetary Fund (IMF) bailout programme.

In a key development, the State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) decided on Monday to reduce the key policy rate by 150 basis points (bps), taking it to 20.5%, effective from June 11, 2024.

In its statement, the MPC said that while the significant decline in inflation since February was broadly in line with expectations, the May outturn was better than anticipated earlier.

This was the first cut in the key policy rate in four years. The last time the central bank reduced the rate was in June 2020 during the pandemic. Since then, the interest rate has gradually gone from 7% to a record high of 22% where it stayed for almost a year.

Globally, the US dollar hovered near a one-month peak against the euro and pushed to a one-week high versus the yen on Tuesday as traders braced for crucial US inflation data and fresh Federal Reserve interest rate forecasts the following day.

The US currency was supported by higher Treasury yields in the aftermath of surprisingly robust domestic jobs data at the end of last week, which sparked a dramatic paring of bets for Fed rate cuts this year.

The US dollar index, which measures the currency against the euro, yen and four other major peers, was little changed at 105.16, after reaching 105.39 on Monday for the first time since May 14.

Oil prices, a key indicator of currency parity, traded lower on Tuesday, as investors waited for key US inflation data and the outcome of the Federal Reserve’s policy meeting to glean a clearer picture of where inflation is heading, and how that will affect fuel demand.

Brent crude futures fell 11 cents, or 0.13%, to $81.52 per barrel by 0433 GMT and US West Texas Intermediate crude futures slipped 3 cents, or 0.04%, to $77.71.

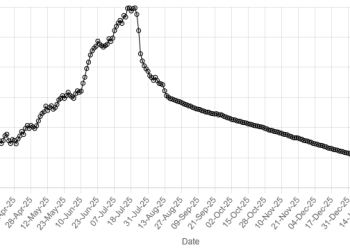

American Dollar Exchange Rate

American Dollar Exchange Rate