The Pakistani rupee remained largely stable against the US dollar, during the intra-day trading in the inter-bank market on Monday.

At 1pm, the currency was hovering at 277.60, a gain of Re0.01 against the US dollar.

During the previous week, rupee remained largely stable against the US dollar in the inter-bank market.

The local unit closed at 277.61, against 277.64 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Last week, the central bank said improvement in Pakistan’s macroeconomic conditions in the financial year (FY) 2023-24 was expected to maintain momentum in FY2024-25 as well, predicting real gross domestic product (GDP) growth of 2.5 – 3.5% for the ongoing fiscal, lower than the government’s target of 3.6%.

Internationally, the US dollar looked set to extend its gains in markets counting down to the US presidential election in two weeks.

Election polls show rising odds of former President Donald Trump winning the Nov. 5 election and are boosting the dollar, since his proposed tariff and tax policies are seen as likely to keep US interest rates high and undermine currencies of trading partners.

Currency moves in major markets last week were driven by the European Central Bank’s dovish rate cut and strong US data that pushed out expectations for how fast US rates can fall, particularly if Trump wins the presidency.

The dollar index measure against major rivals was at 103.45.

It fell 0.3% on Friday as risk appetite picked up broadly across markets after China announced more details of its broad stimulus package, but logged 0.55% gains for the week.

Oil prices, a key indicator of currency parity, steadied in early trading on Monday, following a more than 7% drop last week on worries about demand in China, the world’s top oil importer, and an easing of concerns about potential supply disruptions in the Middle East.

Brent crude futures rose 8 cents, or 0.11%, to $73.14 a barrel by 0120 GMT.

US West Texas Intermediate crude futures gained 10 cents, or 0.14% to $69.32 a barrel.

This is an intra-day update

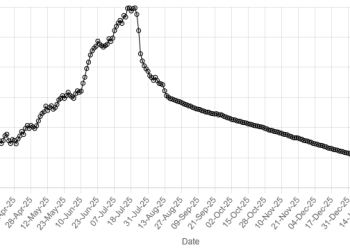

American Dollar Exchange Rate

American Dollar Exchange Rate