Bullish momentum dominated the Pakistan Stock Exchange (PSX) amid ease in tensions between Pakistan and Afghanistan on Monday, with the benchmark KSE-100 Index closing the day with a gain of over 2,400 points.

Driven by renewed investor confidence, the KSE-100 Index hit an intra-day high of 166,421.33.

At close, the benchmark index settled at 166,242.90, an increase of 2,436.69 points or 1.49%.

“Market euphoria was fueled by a major diplomatic breakthrough. Pakistan and Afghanistan reached an immediate ceasefire agreement following high-level negotiations in Doha, Qatar. The accord, emphasiding mutual respect for sovereignty and territorial integrity, was welcomed by investors as a sign of improving regional stability and potential economic cooperation,” brokerage house Topline Securities said in its post-market report.

Banking heavyweights led the charge, with HBL, UBL, BOP, NBP, and AKBL collectively contributing 989 points to the index’s rally, it added.

“Broader market sentiment remained buoyant throughout the session, as investors poured into equities across multiple sectors.”

A follow-up meeting is scheduled for October 25 in Istanbul, Türkiye, where delegations from Pakistan and Afghanistan will discuss further issues and finalise a monitoring mechanism.

During the previous week, the PSX witnessed a rollercoaster ride marked by political uncertainty, border tensions, and renewed investor optimism following Pakistan’s staff-level agreement with the International Monetary Fund (IMF).

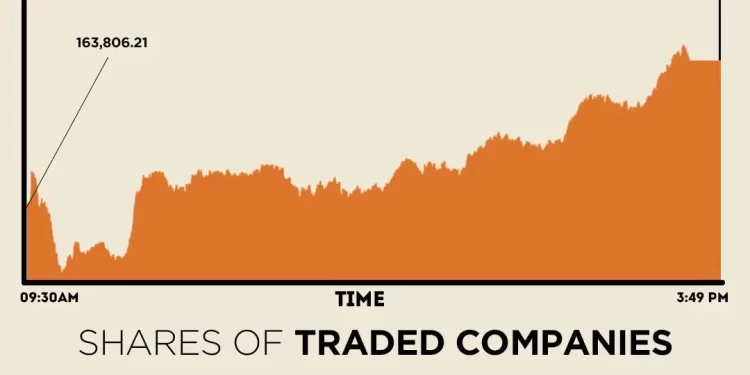

The KSE-100 Index opened at 163,098.19 points and, after a series of volatile sessions, closed at 163,806.22 points, trimming most of its losses, reflecting a weekly gain of 708.03 points, which was 0.4%.

Globally, a jump in the Nikkei led Asian markets higher on Monday as Japan looked close to installing a new prime minister, while a reading on US inflation this week is expected to be no more than a speed bump on the way to further rate cuts there.

Data showed China’s economy grew 1.1% in the third quarter, to top forecasts, while industrial output also beat, with a rise of 6.5%, which could reinforce Beijing’s determination to fight a lengthy trade war with the United States.

But on an annual basis, its 4.8% growth marked the weakest pace in a year.

Shares in South Korea added 1.0%, while MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 1.3%.

Chinese blue chips gained 1.0%, having lost ground last week.

Meanwhile, the Pakistani rupee posted marginal gain against the US dollar, appreciaitng 0.01% in the inter-bank market on Monday. At close, the local currency settled at 281.07, up by Re0.03 against the US dollar, according to the State Bank of Pakistan (SBP).

Volume on the all-share index decreased to 1,478 million from 1,978 million recorded in the previous close. The value of shares increased to Rs51.87 billion from Rs36.99 billion in the previous session.

K-Electric Ltd was the volume leader with 229.71 million shares, followed by WorldCall Telecom with 223.45 million shares, and B.O.Punjab with 184.40 million shares.

Shares of 485 companies were traded on Monday, of which 289 registered an increase, 156 recorded a fall, and 40 remained unchanged.