TOKYO: Japan’s Nikkei share average jumped nearly 3% on the first trading day of 2026, with chip-related stocks leading the charge, as investors brushed off the potential impact of US military action in Venezuela.

The Nikkei was up 2.78% at 51,737.80, as of 0209 GMT on Monday, snapping a two-session losing streak at year-end.

The broader Topix climbed to a record high, rising 2% to 3,478.27.

Shares of chip-testing equipment maker Advantest jumped 6.37%, while the chip-making equipment maker Tokyo Electron climbed 6%.

Chip-related sectors tracked a 4% gain in the US semiconductor index on Wall Street’s opening session of the year on Friday.

“The market turned risk-on as if uncertainties over the impact of the US action on Venezuela had been removed,” said Kazuaki Shimada, chief strategist at IwaiCosmo Securities.

The surge in Japanese equities followed a dramatic weekend of events, which saw the US capture Venezuelan President Nicolas Maduro.

US President Donald Trump said on Saturday he was putting Venezuela under temporary American control.

“Monday’s session mirrored what happened to the Nikkei last year, where chip-related shares led the market.

This may become the trend of this year as well,“ Shimada said.

Technology investor SoftBank Group rose 4% and fibre optic cable maker Fujikura climbed 5.56%. Defence-related shares surged, with IHI and Mitsubishi Heavy Industries climbed 9.24% and 7.39%, respectively, to become the top percentage gainers in the Nikkei.

“The US capture of the Venezuelan president raised fears for geopolitical risks, but that became a tailwind for defence stocks,” Shimada said.

All of the Tokyo Stock Exchange’s 33 industry sub-indexes rose, with the nonferrous metals sector jumping nearly 5% to become the top performer.

Medical services platform operator M3 dropped 2.6%, weighing most in the Nikkei and ranking as the index’s biggest percentage loser.

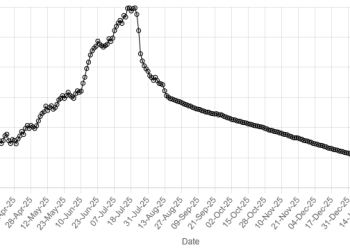

American Dollar Exchange Rate

American Dollar Exchange Rate