TOKYO: Japanese government bond (JGB) yields inched down on Wednesday as traders showed limited reaction to comments from Bank of Japan Governor Kazuo Ueda.

The 10-year JGB yield fell 0.5 basis point (bp) to 1.06%.

Ueda said on Wednesday the central bank expects the economy to move closer to sustainably achieving its 2% inflation target next year, suggesting the timing of its next interest rate hike was nearing.

“The market braced for hawkish comments from him as the yen was weakening,” said Naoya Hasegawa, chief bond strategist at Okasan Securities.

“But reactions to his comments were very limited.”

JGB yields fell and the yen weakened as Ueda struck a cautious note after the central bank kept interest rates steady last week.

Okasan’s Hasegawa said he expects the BOJ to raise its policy rate to 0.5% at its March meeting and the 10-year JGB yield will hit 1.15% at the end of March.

Japan bonds set for weekly drop as PM Ishiba takes office

“But the expectations for the BOJ’s rate hike to 0.75% or 1% will not grow because the market sees the BOJ will be cautious about the further rate hike,” he said.

Swap rates indicated a 44.64% chance for the BOJ to raise rates by 25 bps to 0.5% in January and a 77.64% probability for doing so in March.

The two-year JGB yield fell 0.5 bp to 0.575% and the five-year yield fell 0.5 bp to 0.715%.

The 20-year JGB yield fell 0.5 bp to 1.85% and the 30-year JGB yield fell 0.5 bp to 2.245%.

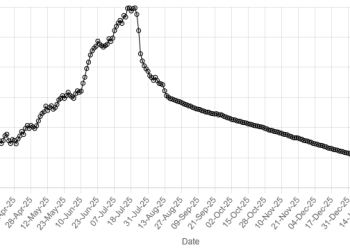

American Dollar Exchange Rate

American Dollar Exchange Rate