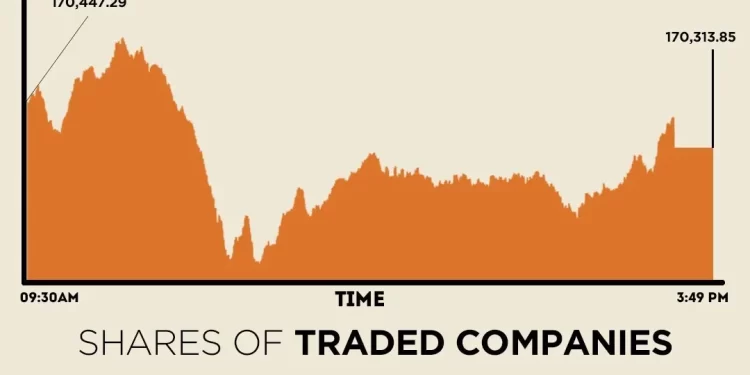

The Pakistan Stock Exchange (PSX) saw a range-bound and volatile session, with the benchmark KSE-100 Index closing marginally lower on Wednesday.

The benchmark index oscillated between gains and losses during the day.

Trading kicked off on a positive note, lifting the index higher, but profit-taking in select index-heavy stocks erased much of those gains by mid-session, dragging the index to an intra-day low of 169,230.49.

Although some recovery was seen later, selling pressure prevailed, and at close, the benchmark index settled at 170,313.85, marginal decrease of 133.44 points or 0.08%.

Strength in UBL, NBP, HBL, AKBL, and PIOC underpinned positive momentum, collectively contributing 771 points to the index. This upside, however, was partly negated by declines in LUCK, OGDC, and ENGROH, which together subtracted 290 points, brokerage house Topline Securities said in its post-market report.

Pakistan’s current account posted a surplus of $100 million in November 2025, data released by the State Bank of Pakistan (SBP) showed on Wednesday.

The surplus came the back of a significantly lower import bill during the month.

Pakistan’s equity market ended yesterday’s session in negative territory as broad-based selling outweighed early optimism, leaving investors cautious despite improved liquidity and heightened participation across key sectors. The KSE-100 Index slipped 294.05 points, or 0.17%, to close at 170,447.30 points.

Internationally, global share markets drifted on Wednesday after a mixed US jobs reading failed to move the needle on the rate outlook there, leaving investors awaiting fresh cues for their next moves.

In the broader market, stocks drifted higher as investors mostly looked past Tuesday’s long-awaited US nonfarm payrolls report.

While job growth rebounded more than expected in November following its biggest drop in nearly five years in October, the unemployment rate rose to 4.6%, the highest in more than four years.

But analysts said there was a lot of noise in the data, which was impacted by the government’s record 43-day shutdown.

MSCI’s broadest index of Asia-Pacific shares outside Japan gained 0.24%, helped by Chinese markets, while Japan’s Nikkei rose 0.35%.

Nasdaq futures and S&P 500 futures were flat after a mixed cash session on Wall Street.

Fed funds futures suggest markets are still pricing in roughly two US rate cuts next year, with the latest labour market reading doing little to shift expectations.

The next key data point for investors will be Thursday’s release of the US November inflation report.

Meanwhile, the Pakistani rupee registered improvement against the US dollar, appreciating 0.01% in the inter-bank market on Wednesday. At close, the local currency settled at 280.27, a gain of Re0.03 against the greenback.

Volume on the all-share index decreased to 1,068.51 million from 1,176.64 million recorded in the previous close. The value of shares decreased to Rs51.80 billion from Rs53.47 billion in the previous session.

B.O.Punjab was the volume leader with 90.62 million shares, followed by Hascol Petrol with 83.92 million shares, and TPL Properties with 53.15 million shares.

Shares of 483 companies were traded on Wednesday, of which 178 registered an increase, 255 recorded a fall, and 50 remained unchanged.

American Dollar Exchange Rate

American Dollar Exchange Rate