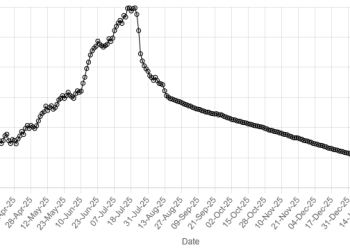

The Pakistan Stock Exchange (PSX) witnessed a volatile session on Wednesday as its benchmark KSE-100 Index crossed 86,000 during intra-day trading, but retreated on late-selling and closed the day flat.

The KSE-100 started the session with a strong buying spree, hitting an intra-day high of 86,451.43.

However, the second half of the session faced selling pressure that erased the intra-day gains.

At close, the KSE-100 Index settled flat at 85,669.28, a marginal gain of 5.30 points or 0.01%.

“The session experienced significant volatility, peaking at 86,451 and dipping to 85,444, largely due to profit-taking and the index’s inability to sustain levels above 86,000. The market was primarily supported by local institutions’ buying activity,” brokerage house Topline Securities said in its post-market report.

Key contributors to the index included MCB, LCI, BAHL, HUBC, and HBL, which collectively added 292 points. However, negative movements from FFC, EFERT, and POL deducted 215 points from the index, it added.

The KSE-100 crossed 86,000 for the first time in history on Wednesday.

Experts have been crediting the ongoing bullish trend to a higher-than-expected decline in the inflation rate, which has raised hopes for a further cut in the policy rate at the upcoming Monetary Policy Committee (MPC) meeting in November.

“Greater than expected decline in headline inflation and anticipated rate cuts in the next two MPC meetings (Nov & Dec)” is driving this trend, Saad Khan, analyst at Imran Ismail Securities, told media.

“A positive real interest rate of more than 10% advocates further rate cuts which can go down by 250-350bps,” he said.

On Tuesday, the PSX’s record-breaking trend continued due to investors’ strong interest and healthy buying, mainly in the E&P and fertilizer sectors. The benchmark index settled at 85,663.98, an increase of 753.68 points or 0.89%.

Globally, Chinese stocks tumbled on Wednesday alongside their Hong Kong peers. Investors booked profits after a blistering rally, and officials failed to inspire confidence in stimulus plans intended to revive the economy.

Benchmark indexes in China declined more than 5% by midday in a sharp reversal from the moves seen the day before, when markets returned from the week-long National Day holiday with a bang and scaled more than two-year highs.

The Shanghai Composite index fell 5.3%, while the blue-chip CSI300 index dropped 5.4%, both poised to snap a 10-day winning streak.

Meanwhile, the Pakistani rupee ended marginally weaker against the US dollar, depreciating 0.02% in the inter-bank market on Wednesday. At close, the currency settled at 277.72, a loss of Re0.05 against the greenback.

Volume on the all-share index increased to 596.05 million from 506.56 million on Tuesday.

However, the value of shares decreased to Rs31.34 billion from Rs33.05 billion in the previous session.

K-Electric Ltd was the volume leader with 55.8 million shares, followed by Hub Power Co.XD with 39.67 million shares, and PTCL with 32.23 million shares.

Shares of 448 companies were traded on Wednesday, of which 208 registered an increase, 172 recorded a fall, while 68 remained unchanged.

American Dollar Exchange Rate

American Dollar Exchange Rate