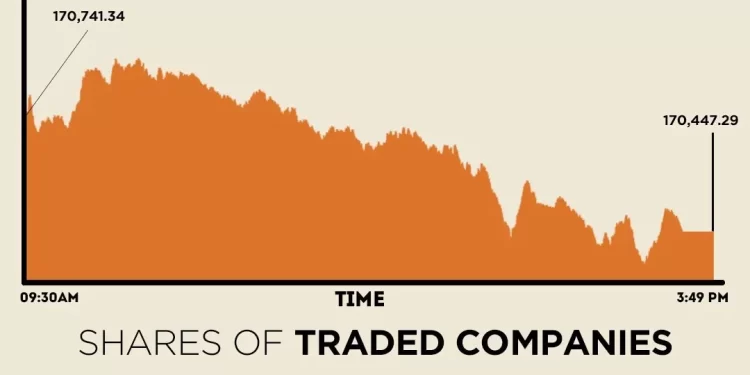

The Pakistan Stock Exchange (PSX) ended Tuesday’s trading session in the red, with the benchmark KSE-100 Index shedding nearly 300 points as late-session selling erased the intra-day gains.

Trading kicked off on a positive note, as investors rejoiced over the central bank’s decision to cut the key interest rate by 50 basis points, pushing the KSE-100 to an intra-day high of 171,922.60

However, the trend reversed during the final hours of trading as investors booked profits in select index heavyweights, dragging the index to an intra-day low of 170,191.98.

At close, the benchmark index settled at 170,447.29, a decrease of 294.05 points or 0.17%.

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) on Monday, in a surprise move, cut the policy rate by 50 bps to support sustainable economic growth.

This move was unexpected, as most market analysts had expected a status quo. However, to reinforce ongoing price stability, the committee, in its meeting, decided to lower the policy rate to 10.5%, effective from December 16, 2025.

On Monday, PSX witnessed a positive session with the benchmark index closing at a new all-time high amid sustained investor confidence and an improving market outlook. The KSE-100 Index gained 876.82 points, or 0.52%, to close at 170,741.35 points.

Globally, Asian stocks tumbled while the dollar drifted near two-month lows on Tuesday as investors adopted a cautious approach ahead of a slate of US data, including the jobs report, that may help gauge the trajectory for Federal Reserve policy next year.

The defensive mood kept risk assets under pressure, including bitcoin, which hit a two-week low in the previous session and was steady at $86,407.53.

Safe-haven gold flirted with eight-week highs and bought $4,307.69 per ounce, up 0.15% on the day.

On top of the combined US employment reports for October and November due later on Tuesday, investors are also watching out for the inflation report on Thursday, although several key details will be missing after the longest government shutdown in history prevented data collection.

In equity markets, MSCI’s broadest index of Asia-Pacific shares outside Japan was down 1% in early trading. Tokyo’s Nikkei and South Korea’s benchmark index both fell over 1%. Nasdaq futures and European futures fell 0.5%, pointing to wobbles at the open.

Meanwhile, the Pakistani rupee registered marginal improvement against the US dollar in the inter-bank market on Tuesday. At close, the local currency settled at 280.30, a gain of Re0.01 against the greenback.

Volume on the all-share index increased to 1,176.64 million from 905.68 million recorded in the previous close. The value of shares improved to Rs53.47 billion from Rs47.72 billion in the previous session.

Pak Int.Bulk was the volume leader with 101.81 million shares, followed by B.O.Punjab with 88.66 million shares, and TPL Properties with 80.37 million shares.

Shares of 482 companies were traded on Tuesday, of which 161 registered an increase, 290 recorded a fall, and 31 remained unchanged.