The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index closed the last trading day of 2024 nearly flat on Tuesday, while the index registered massive 84% growth in the year as it added over 52,000 points amid positive economic indicators.

On Tuesday, the KSE-100 started the session positive, hitting an intra-day high of 116,700.02.

However, a selling spree in the latter hours pushed the index into the negative territory.

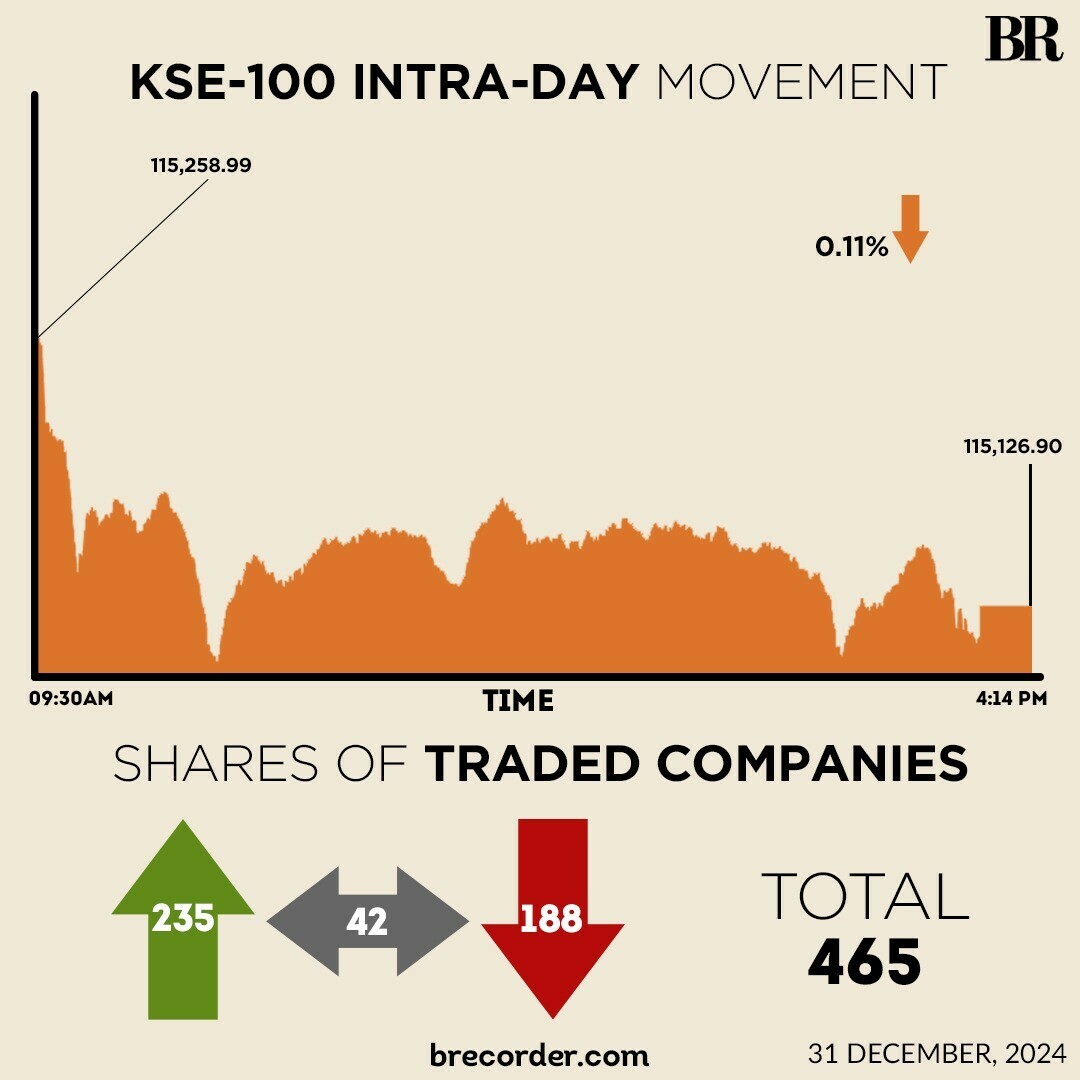

At close, the benchmark index settled at 115,126.90, down by 132.09 points or 0.11.

On Monday, the KSE-100 gained over 3,900 points to settle above 115,000.

It closed the year 2024 with a massive gain of 84%, adding 52,676 points during the year, according to brokerage house Arif Habib Limited (AHL).

“This performance marks the highest return since CY02, when it was 112%,” AHL said.

The key contributors to the exceptional performance included economic and political stability, enhanced liquidity, robust fundamentals, sustained backing from the ongoing International Monetary Fund (IMF) programme, it said.

The main sectors driving the growth in 2024 were banks, contributing 13,847 points, followed by fertilisers with 11,169 points and E&P chipping in 10,012 points. The sectors contributed 35,028 points to the index making 66% total contribution, according to the brokerage house.

In terms of individual companies, FFC contributed the most with 6,086 points, MARI added 3,977 points, UBL added 3,957 points, and OGDC accounted for 2,613 points, AHL said.

Another brokerage house Topline Securities said improving macroeconomic indicators under the new IMF programme, i.e. falling inflation, falling yields on fixed income, aggressive monetary easing of 900 basis points by the central bank improved external accounts, stable currency, and political stability, drove the strong performance of market in 2024.

In a key development, Prime Minister Shehbaz Sharif on Tuesday rolled out ‘Uraan Pakistan’, a five-year national economic plan aimed at steering the country toward sustainable growth.

According to the Ministry of Planning, ‘Uraan Pakistan-Home-grown National Economic Transformation Plan’ will be a five-year national economic plan and will cover from 2024 to 2029.

Globally, Asian stocks eased on Tuesday in cautious end-of-year trading that has seen investors scale back bets of deep U.S. rate cuts in 2025 and brace for the incoming Trump administration, with the dollar standing tall against most other currencies.

Volumes were light with a holiday for the New Year looming and Japan on holiday for the rest of the week, with the Santa-rally losing some steam as elevated Treasury yields weigh on high equity valuations and boost the greenback.

MSCI’s broadest index of Asia-Pacific shares outside Japan, nudged down 0.2% but was set for an 8% gain in 2024, its second straight year in the black.

China’s blue-chip CSI300 index, was flat while Hong Kong’s Hang Seng index, was 0.3% higher in early trading.

Meanwhile, the Pakistani rupee concluded the final session of the calendar year on a negative note against the US dollar, depreciating 0.03% in the inter-bank market on Tuesday. At close, the currency settled at 278.55 for a loss of Re0.07 against the greenback.

Volume on the all-share index increased to 1,236.87 million from 1,059.02 million on Monday.

The value of shares rose to Rs44.22 billion from Rs40.89 billion in the previous session.

Cnergyico PK was the volume leader with 213.35 million shares, followed by Pace (Pak) Ltd with 66.22 million shares, and WorldCall Telecom with 65.77 million shares.

Shares of 465 companies were traded on Tuesday, of which 235 registered an increase, 188 recorded a fall, while 42 remained unchanged.