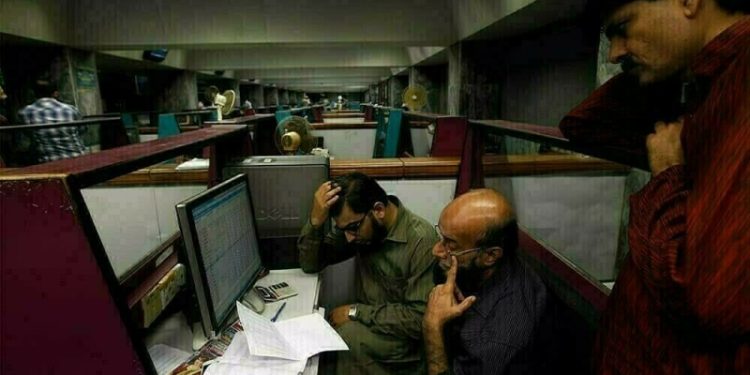

Selling pressure continued at the Pakistan Stock Exchange (PSX) as its benchmark KSE-100 Index closed negative for the fourth consecutive session on Monday amid lack of fresh positive triggers.

Trading remained volatile at the KSE-100 throughout the day, with the index hitting an intraday high of 112,524.81 and an intra-day low of 111,513.67.

At close, the benchmark index settled at 111,743.53, down by 341.76 points or 0.30%.

“Initial optimism faded as the lack of positive triggers dampened investor sentiment, triggering a sell-off in the latter half of the session. With no major catalysts to sustain momentum, the market drifted into negative territory by the close,” brokerage house Topline Securities said in its post-market report.

The upward movement was primarily driven by LUCK, BAHL, BOP, UBL, and FATIMA, collectively contributing 296 points to the index. Conversely, MARI, PPL, TRG, SEARL, and OGDC dragged the index down by 301 points, it added.

BOP, from the banking sector, attracted investor interest after announcing its 4QFY24 results, according to Topline.

On Friday, the KSE-100 closed the trading session down by 479 points as late-session selling erased the gains the index had made in the first half of the day.

In the four sessions, including today’s one, the KSE-100 lost over 1,260 points.

Internationally, Asia share markets crept higher on Monday as Hong Kong’s tech sector stole the limelight, while upbeat Japanese economic growth contrasted with a weak US retail sales report to lift the yen on the US dollar.

Geopolitics remained in focus with reports that talks on the Russian-Ukraine conflict will begin in Saudi Arabia this week, though the participants are not entirely clear.

The imminent threat of reciprocal US tariffs has receded until April, but the risk that they might include levies based on value-added taxes in other countries was a major worry.

The Financial Times reported on Sunday that the European Commission would explore tough import limits on certain foods made to different standards to protect its farmers, echoing President Donald Trump’s reciprocal trade policy.

For now, investors were just relieved that major tariffs had not already been introduced and MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.3%.

Tokyo’s Nikkei edged up 0.1% after Japan reported surprisingly strong economic growth of an annualised 2.8% for the fourth quarter. The gains were limited by a further rise in the yen to 151.80 per dollar.

South Korean shares added 0.8% and Taiwan’s rallied 1.2%.

Meanwhile, the Pakistani rupee lowered against the US dollar, depreciating 0.16% in the inter-bank market on Monday. At close, the rupee settled at 279.67, a loss of Re0.46 against the greenback.

Volume on the all-share index increased to 511.19 million from 457.05 million recorded in the previous close.

However, the value of shares declined to Rs19.64 billion from Rs23.22 billion in the previous session.

B.O.Punjab was the volume leader with 184.43 million shares, followed by Power Cement with 38.64 million shares, and WorldCall Telecom with 33.03 million shares.

Shares of 435 companies were traded on Monday, of which 130 registered an increase, 235 recorded a fall, while 70 remained unchanged.

Selling pressure continued at the Pakistan Stock Exchange (PSX) as its benchmark KSE-100 Index closed negative for the fourth consecutive session on Monday amid lack of fresh positive triggers.

Trading remained volatile at the KSE-100 throughout the day, with the index hitting an intraday high of 112,524.81 and an intra-day low of 111,513.67.

At close, the benchmark index settled at 111,743.53, down by 341.76 points or 0.30%.

“Initial optimism faded as the lack of positive triggers dampened investor sentiment, triggering a sell-off in the latter half of the session. With no major catalysts to sustain momentum, the market drifted into negative territory by the close,” brokerage house Topline Securities said in its post-market report.

The upward movement was primarily driven by LUCK, BAHL, BOP, UBL, and FATIMA, collectively contributing 296 points to the index. Conversely, MARI, PPL, TRG, SEARL, and OGDC dragged the index down by 301 points, it added.

BOP, from the banking sector, attracted investor interest after announcing its 4QFY24 results, according to Topline.

On Friday, the KSE-100 closed the trading session down by 479 points as late-session selling erased the gains the index had made in the first half of the day.

In the four sessions, including today’s one, the KSE-100 lost over 1,260 points.

Internationally, Asia share markets crept higher on Monday as Hong Kong’s tech sector stole the limelight, while upbeat Japanese economic growth contrasted with a weak US retail sales report to lift the yen on the US dollar.

Geopolitics remained in focus with reports that talks on the Russian-Ukraine conflict will begin in Saudi Arabia this week, though the participants are not entirely clear.

The imminent threat of reciprocal US tariffs has receded until April, but the risk that they might include levies based on value-added taxes in other countries was a major worry.

The Financial Times reported on Sunday that the European Commission would explore tough import limits on certain foods made to different standards to protect its farmers, echoing President Donald Trump’s reciprocal trade policy.

For now, investors were just relieved that major tariffs had not already been introduced and MSCI’s broadest index of Asia-Pacific shares outside Japan firmed 0.3%.

Tokyo’s Nikkei edged up 0.1% after Japan reported surprisingly strong economic growth of an annualised 2.8% for the fourth quarter. The gains were limited by a further rise in the yen to 151.80 per dollar.

South Korean shares added 0.8% and Taiwan’s rallied 1.2%.

Meanwhile, the Pakistani rupee lowered against the US dollar, depreciating 0.16% in the inter-bank market on Monday. At close, the rupee settled at 279.67, a loss of Re0.46 against the greenback.

Volume on the all-share index increased to 511.19 million from 457.05 million recorded in the previous close.

However, the value of shares declined to Rs19.64 billion from Rs23.22 billion in the previous session.

B.O.Punjab was the volume leader with 184.43 million shares, followed by Power Cement with 38.64 million shares, and WorldCall Telecom with 33.03 million shares.

Shares of 435 companies were traded on Monday, of which 130 registered an increase, 235 recorded a fall, while 70 remained unchanged.