The Pakistan Stock Exchange (PSX) experienced another volatile session on Wednesday, with the benchmark KSE-100 Index ending the year’s last session on a weaker note after briefly scaling new heights during intra-day trading.

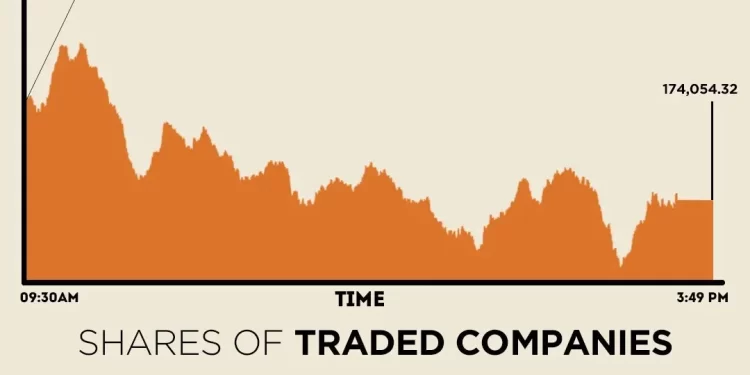

The market opened firmly, and the KSE-100 surged to an intra-day high of 175,232.90, crossing the 175,000 mark for the first time in history.

However, profit-taking emerged soon after the opening surge, dragging the index lower through the late morning session. By mid-day, selling pressure intensified, dragging the benchmark index to an intra-day low of 173,564.33.

At close, the KSE-100 Index settled at 174,054.32, a decrease of 418.47 points or 0.24%.

However, despite ending the year’s last session in the red, the KSE-100 Index achieved an impressive 51% return in the calendar year 2025 (CY25), closing at a new high and extending its three-year streak of double-digit growth, following 55% in CY23 and 84% in CY24, said Arif Habib Limited (AHL).

“The index also remained the second-best performing frontier market after Romania during the year,” said AHL.

The brokerage house noted that KSE-100 outperformed other asset classes such as real estate (17%), PIBs (12%), T-Bills (12%), Defence Savings Certificates (11%), and bank deposits (9%), while gold (65%) delivered higher returns over the same timeframe.

On Tuesday, the PSX continued positive momentum, and the KSE-100 Index closed on a strong note at a fresh all-time high level. The index increased by 576.45 points to close at a new all-time high of 174,473 points.

Internationally, Asian stocks drifted on the last trading day of a year that has seen investors brush off much of the tariff-related uncertainty and embrace AI chip stocks, while the dollar’s dismal year has left the euro and sterling standing tall.

Japanese markets are closed for the rest of the week, and with most markets closed on Thursday for the New Year’s Day holiday, volumes are likely to be thin, and moves muted.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.17% lower on Wednesday as investors weighed the minutes of the Federal Reserve’s December meeting that underscored deep divisions among policymakers about US rates.

The index is poised to clock a 27% increase for the year, its sharpest rise since 2017, mainly on a strong rally in chipmakers amid the boom in artificial intelligence-related stocks.

China’s blue-chip index inched higher, on course for an 18% increase for the year, while Hong Kong’s Hang Seng slipped 0.7% but was looking to clock a 28% gain for 2025 as investors shrugged off trade war worries.

South Korea’s Kospi is the best-performing major stock market in the world, rising 76% in the year, with a lot of those gains coming from SK Hynix and Samsung.

Meanwhile, the Pakistani rupee strengthened against the US dollar, appreciating 0.01% in the inter-bank market during the final trading session of the year on Wednesday. At close, the local currency settled at 280.12, a gain of Re0.04 against the greenback.

Volume on the all-share index increased to 957.24 million from 851.04 million recorded in the previous close. The value of shares declined to Rs44.23 billion from Rs44.90 billion in the previous session.

K-Electric Ltd was the volume leader with 95.89 million shares, followed by PIA Holding Company with 61.81 million shares, and Pak Int.Bulk with 47.66 million shares.

Shares of 481 companies were traded on Wednesday, of which 221 registered an increase, 223 recorded a fall, and 37 remained unchanged.

American Dollar Exchange Rate

American Dollar Exchange Rate