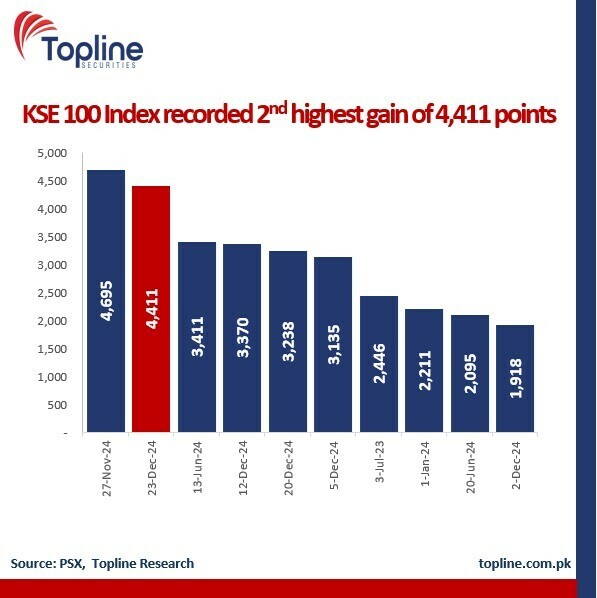

Massive buying was witnessed at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index surged over 4,400 points, marking the second largest single-day increase point-wise, on Monday.

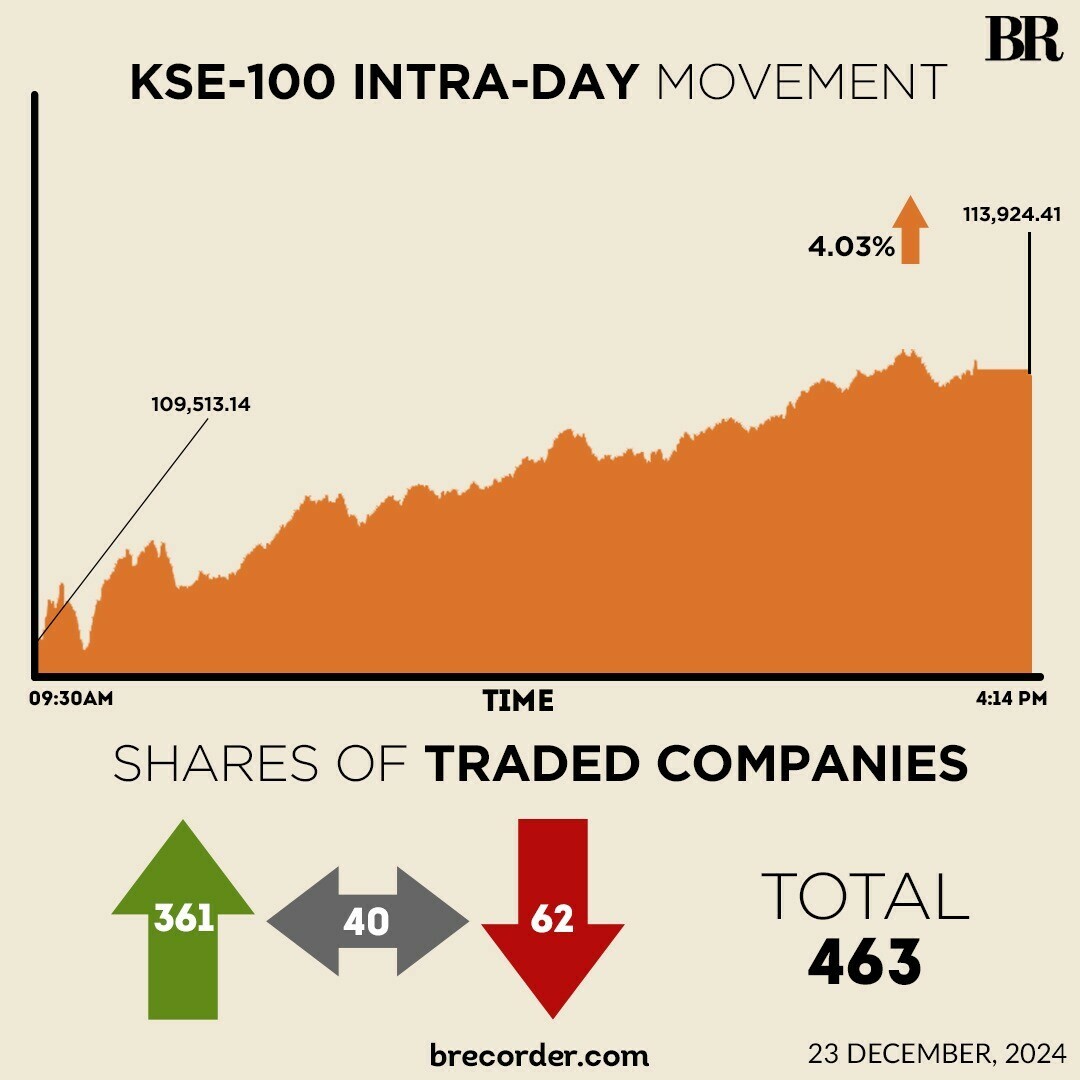

Positive momentum persisted throughout the trading session, with the KSE-100 hitting an intraday high of 114,189.71.

At close, the benchmark index settled at 113,924.41, an increase of 4,411.27 points or 4.03%.

Across-the-board buying was observed in key index sectors including automobile assemblers, cement, chemical, commercial banks, fertiliser, oil and gas exploration companies, OMCs and power generation. Index-heavy stocks including HUBCO, PSO, SSGC, SNGP, MARI, OGDC, PPL, POL, HBL, MCB, MEBL and UBL traded in the green.

It was the second largest single-day gain for KSE-100 in terms of points, brokerage house Topline Securities said.

The buying momentum was driven by several indicators including the recent correction that followed the central bank’s decision to cut the policy rate by 200bps, in line with expectations, bringing the rate down to 13%, a total decline of 900bps from its recent peak.

“The market continued its recovery following last week’s losses, driven by speculation that the selling by local funds has subsided,” Topline Securities said in its post-market report.

Equities outperformed major asset classes in 2024 in Pakistan as the KSE-100 provided a gain of 75% (January 01, 2024, till December 20, 2024). Topline said the gain was inclusive of dividends received during the period.

During the previous week, the PSX remained under severe pressure due to heavy selling mainly by mutual funds and year-end profit-taking by institutions. The KSE-100 plunged by 4,788.65 points weekly and closed at 109,513.15 points.

Globally, Asian shares rallied on Monday after a benign reading on US inflation restored some hope for further policy easing next year, while there was relief that Washington had averted a government shutdown.

After the bonanza of recent central bank decisions, this week is much quieter with only the minutes of a few of those meetings due. There are no Federal Reserve speeches and U.S. data is of secondary importance.

Otherwise, the themes were largely the same, with the dollar underpinned by a relatively strong economy and higher bond yields, which in turn is a burden for commodities and gold.

It is also a headache for emerging market countries, which are having to intervene to stop their currencies from falling too far and stoking domestic inflation.

For now, the afterglow from the U.S. inflation report was enough to lift MSCI’s broadest index of Asia-Pacific shares outside Japan, rose 0.3%.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.05% in the inter-bank market on Monday. At close, the currency settled at 278.57 for a loss of Re0.15 against the greenback.

Volume on the all-share index increased to 857.83 million from 754.92 million on Friday.

The value of shares rose to Rs50.55 billion from Rs39.42 billion in the previous session.

WorldCall Telecom was the volume leader with 71.05 million shares, followed by Cnergyico PK with 66.47 million shares, and Pak Elektron with 38.65 million shares.

Shares of 463 companies were traded on Monday, of which 361 registered an increase, 62 recorded a fall, while 40 remained unchanged.