The Pakistan Stock Exchange (PSX) witnessed a volatile session on Monday as its benchmark KSE-100 Index swayed both ways on bouts of buying and selling before closing the day lower by 1,332 points.

The market kicked off trading on a positive note, with the KSE-100 hitting an intra-day high of 118,765.

However, selling pressure soon emerged, dragging the index to an intra-day low of 115,941.

At close, the benchmark index settled at 116,255.13, a decrease of 1,331.86 points or 1.13%.

“The day’s bearish sentiment was largely influenced by concerns in the gas sector, following reports of a significant rise in the circular debt. This concerning development dampened investor confidence, leading to widespread profit-taking across the board,” brokerage house Topline Securities said in its post-market report.

The cement sector extended its downward trend as investors chose to book profits, spurred by reports of disagreements among cement players, it added.

“While some are advocating for an increased market share, others are favouring adjustments in geographic sales to secure higher retention prices,” Topline said.

Key contributors to the upward trajectory included ENGROH, HMB, AICL, MCB, and MUREB, collectively adding 395 points. On the other hand, substantial declines in OGDC, PSO, FFC, EFERT, and SNGP weighed heavily on the market, accounting for a combined loss of 698 points, according to the report.

Another brokerage house Intermarket Securities said it was a good time to accumulate cement on dips.

“The cement sector can outperform defensive sectors over the next six months if the hitherto pricing discipline sustains, in our view,” it said.

During the previous week, PSX witnessed a bullish trend and hit new highest-ever levels with healthy gains during the outgoing week ended on January 03, 2025, on the back of investor strong interest coupled with institutional support. The KSE-100 Index surged by 6,235.80 points on a week-on-week basis and closed at its new highest-ever level of 117,586.98 points.

Internationally, share markets got off to a patchy start in Asia on Monday ahead of a week brimming with economic news that should underline the relative outperformance of the United States and support the dollar’s ongoing bull run.

Political uncertainty remained a feature as the Globe and Mail reported embattled Canadian Prime Minister Justin Trudeau would announce his resignation as early as Monday.

The star of the US data line up is the December payrolls report on Friday, where analysts expect a rise of 150,000 with unemployment holding at 4.2%.

These will be reviewed by data on ADP hiring, job openings and weekly jobless claims, along with surveys on manufacturing, services and consumer sentiment.

Anything upbeat would support the case for fewer rate cuts from the Federal Reserve, and markets have already scaled back expectations to just 40 basis points for 2025.

Minutes of the Fed’s last meeting due Wednesday will offer colour on their dot plot predictions, while there will be plenty of live comment with at least seven top policymakers speaking including influential Fed Governor Christopher Waller.

MSCI’s broadest index of Asia-Pacific shares outside Japan, tab gained 0.6%, having lost 1% last week.

Meanwhile, the Pakistani rupee registered a marginal decline against the US dollar, depreciating 0.02% in the inter-bank market on Monday. At close, the currency settled at 278.62 for a loss of Re0.06 against the greenback.

Volume on the all-share index decreased to 819.80 million from 935.78 million on Friday.

The value of shares declined to Rs38.33 billion from Rs39.62 billion in the previous session.

Cnergyico PK was the volume leader with 83.17 million shares, followed by Fauji Foods Ltd with 47.30 million shares, and WorldCall Telecom with 41.29 million shares.

Shares of 458 companies were traded on Monday, of which 113 registered an increase, 291 recorded a fall, while 54 remained unchanged.

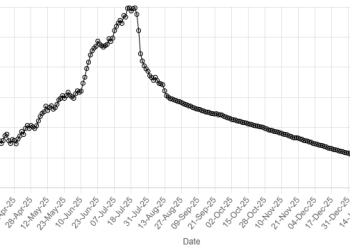

American Dollar Exchange Rate

American Dollar Exchange Rate