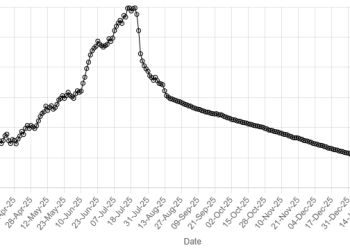

The KSE-100 saw wild swings on Friday, crossing the 80,000 barrier with an over 1,250-point gain in the morning before massive profit-taking and resistance saw it plummet to 78,300 in the second half of the session.

Trading began with a bullish momentum carried over from the previous few sessions, taking the benchmark index to an intra-day high of 80,059.87 – the highest in history.

However, some profit-taking erased the intra-day gains by the end of the first half of the session.

The second half began with further selling as the index fell 456.58 points, followed by some late-session buying.

However, some support helped the benchmark index settle at 78,810.49, up by 8.96 points or 0.01%, by close.

Earlier, selling was seen in key sectors including automobile assemblers, chemical, cement, commercial banks, fertiliser, oil and gas exploration companies and OMCs.

The market had been bullish since the budget erased fears that the capital markets will see higher taxation, propelling the index to its all-time highs. As Pakistan nears a bailout agreement with the International Monetary Fund (IMF), experts see the buying trend to continue with some consolidation and intermittent profit-taking.

“Positive sentiments have been led by tax-laden budget, which investors feel will help in getting the IMF long-term loan,” said Mohammed Sohail, CEO Topline Securities, earlier during the trading session.

Finance Bill 2024: Wealth Statement now in sharp focus

On Thursday, banking sector had witnessed heavy buying interest as the benchmark KSE-100 Index gained nearly 2,100 points to settle at then new record high of 78,802 during the first trading session post-Eid holidays.

Globally, India’s benchmark Nifty 50 index hit a record high on Friday, boosted by information technology stocks after Accenture’s upbeat annual revenue forecast.

The NSE Nifty 50 was up 0.25% at 23,627.10 as of 9:19 a.m. IST, while the S&P BSE Sensex added 0.23% to 77,650.48.

American Dollar Exchange Rate

American Dollar Exchange Rate