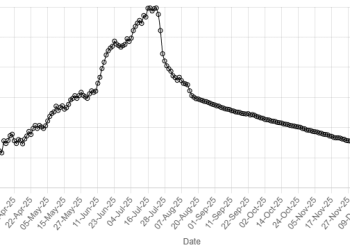

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 closed at fresh all-time high on Friday, as analysts say improving macroeconomic stability and strong corporate earnings have helped the index post record gains.

The benchmark index closed positive for the ninth consecutive session after it hit an intra-day high 169,988.62 during the day, followed by selling that trimmed the intra-day gains.

At close, the benchmark index settled at 168,990.07, a gain of 500.44 points or 0.30%.

Analysts attributed the ongoing momentum to positive economic indicators and excess liquidity available in the market.

“The market rally is being fueled by improving macroeconomic stability, strong corporate earnings momentum, and renewed investor confidence,” Waqas Ghani, Head of Research at JS Global, told media.

“Liquidity remains ample, supporting broad-based participation across key sectors,” he added.

Top positive contribution to the index came from FFC, UBL, HUBC, SYS and AICL, as they cumulatively contributed 980 points to the index. After yesterday’s rally in banking sector, some profit taking was observed in the sector, as MEBL, MCB, HBL and BAHL cumulatively lost 577 points to weigh down on the index, brokerage house Topline Securities said in its post-market report.

On Thursday, the PSX saw a strong and broadly positive trading session, with major indices climbing, mainly attributed to institutional buying. The KSE-100 index surged 2,849.29 points, or 1.72%, to end Thursday’s session at 168,489.63 points.

On a weekly basis, the KSE-100 Index gained 4.15%.

The rally came on account of continuous buying by mutual funds and individuals amid low return on other asset classes, according to Topline.

Internationally, Asian stocks were poised for solid weekly gains on Friday as rising odds of the Federal Reserve cutting rates in the near-term helped cushion jitters around a U.S. government shutdown that has pushed gold to record highs and weighed on the dollar.

Investors have mostly shrugged off the government shutdown, the 15th since 1981, even as it resulted in suspension of scientific research, financial oversight and delayed crucial economic data, including the jobs report on Friday.

Part of the reason for the lack of market reaction is that historically, shutdowns have had a limited impact on economic growth and market performance.

MSCI’s index of Asia-Pacific shares was up 0.14%, just shy of the record high it touched on Thursday. The index was set for an over 2% gain for the week and has risen 23% so far this year. With China and parts of Asia closed for a long holiday, volumes are likely to be thin in the region.

Japan’s Nikkei was up 0.75% in early trading, not far from the record high it touched last month ahead of the crucial weekend vote that will determine the next prime minister and set the tone for fiscal and monetary policy outlook.

Asian markets were taking cues from Wall Street, where all three major indexes closed at record highs, buoyed by technology stocks as investor enthusiasm for all things AI remains unchallenged.

Meanwhile, the Pakistani rupee saw a slight gain against the US dollar in the inter-bank market on Friday. At close, the currency settled at 281.26, a gain of Re0.01 against the greenback.

Volume on the all-share index slightly decreased to 1,573.35 million from 1,573.40 million recorded in the previous close. The value of shares rose to Rs78.67 billion from Rs70.19 billion in the previous session.

Cnergyico PK was the volume leader with 211.44 million shares, followed by B.O.Punjab with 131.82 million shares, and WorldCall Telecom with 103.93 million shares.

Shares of 485 companies were traded on Friday, of which 201 registered an increase, 254 recorded a fall, while 30 remained unchanged.