TOKYO: The U.S. dollar and major currencies steadied on Friday, as traders assessed the potential impact of Washington’s reciprocal tariffs which will not be immediately implemented, while a U.S. producer price report eased inflation concerns.

U.S. President Donald Trump directed his economic team on Thursday to formulate plans for reciprocal tariffs on every country that imposes taxes on U.S. imports.

Although the tariffs would not be implemented immediately, they could be enforced within weeks as Trump’s trade and economic team studies bilateral tariff and trade relationships, a White House official said.

The delayed implementation buoyed expectations that there may yet be room for countries to negotiate.

Dollar dips after PPI data

“Tariff ambiguity still reigns, but markets are currently drawing some comfort from the news the next set won’t come into effect before April,” Ray Attrill, head of FX strategy at National Australia Bank, wrote in a research note.

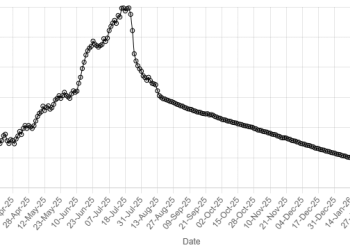

The greenback was on the back foot, hovering near its weakest since January 27 at 107.25 as the latest producer price report overshadowed looming tariff threats.

Headline U.S. PPI came in above forecasts, but components suggest core PCE inflation, the Federal Reserve’s preferred measure, is likely to be lower than feared for January when it is released later this month.

While PPI details were “more favourable,” key components of U.S. consumer prices in January showed strong increases, indicating PCE may still rise from the previous month at a pace above the Fed’s 2% inflation target, said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

“We expect the Fed to remain cautious amid concerns about the stalled disinflation process and President Trump’s tariff increases,” she added.

Futures traders have about 33 basis points of cuts priced in for this year. That is up from 29 basis points before Thursday’s data, but down from 37 basis points before the CPI data was released on Wednesday.

The dollar index, which measures the greenback against a handful of peers, was nearly flat at 107.07.

U.S. Treasury yields declined as investors took comfort in the PPI numbers, helping the yen to claw back most of its losses after weakening to 154.80 on Wednesday.

The Japanese currency was up marginally at 152.64 on Friday but remained on track for its first weekly loss since early January.

The euro loitered near its highest in more than two weeks at $1.046925 in early Asian trade, supported by optimism around potential peace talks between Ukraine and Russia. It was last down 0.04% at $1.0461.

On Wednesday, Trump discussed the war in Ukraine in phone calls with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskiy.

He said on Thursday that Ukraine would have a seat at the table during any peace negotiations with Russia.

Sterling touched $1.25705, its firmest since January 7, and was last down 0.07% at $1.256. Data on Thursday showed that Britain’s economy unexpectedly grew by 0.1% in the final quarter of last year.

The Canadian dollar stood just above a two-month high of C$1.4184 hit in the previous day, boosted by the fall in U.S. Treasury yields.