Australian shares advanced on Thursday in a session of broad-based gains led by miners and gold stocks, with positive sentiment bolstered by Wall Street’s performance.

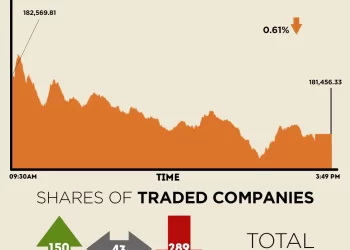

The S&P/ASX 200 index rose as much as 0.7% to 8,906.30 points earlier in the session, its highest since September 2, and was up 0.6% by 0032 GMT.

The benchmark ended 0.1% lower on Wednesday.

Miners led gains on the benchmark for the day by

advancing 1.9% as copper prices rose. The sub-index hit its

highest level since late-December 2023.

Shares of miners BHP, Rio Tinto and Fortescue rose between 0.9% and 1.4%.

Gold stocks jumped to a record high, rising 2.5%, as surging bullion prices on safe-haven demand lifted the commodity.

Shares of gold miners St Barbara advanced 5%, while Evolution Mining, Northern Star Resources and Genesis Minerals were up between 1.9% and 2.6%.

Technology stocks rose 0.3%, tracking their overseas peers, which closed higher overnight as investors shrugged off weak private payrolls data and uncertainty around the first day of the U.S. government shutdown.

Wall Street gains often lift Australian markets by boosting global investor sentiment and risk appetite.

Banks added 0.6% to the benchmark’s gains, with shares of the “Big Four” banks up between 0.3% and 0.5%.

Healthcare stocks advanced 1.3%, while energy stocks inched 0.1% higher.

Further south, New Zealand’s benchmark S&P/NZX 50 index fell 0.2% to 13,400.88 points.

Investors are now focused on next week’s Reserve Bank of New Zealand policy decision, with ANZ analysts expecting a 25-basis-point rate cut to 2.75%, according to a note.