Most stock markets in the Gulf closed higher on Monday as investors waited for a reading of U.S. inflation data later this week for insights into the Federal Reserve’s monetary policy path.

Fed officials appear on track to cut interest rates this month after data showed the U.S. labor market remained strong but continued to cool in November.

U.S. employers added 227,000 jobs last month, a rebound from a hurricane-related slowdown in October, but the unemployment rate inched up to 4.2%, the Labor Department’s monthly employment report showed on Friday.

According to the CME Group’s FedWatch Tool, markets currently see a roughly 85% chance of a 25-basis-point rate cut this month.

The Fed’s decisions impact monetary policy in the Gulf region where most currencies, including Saudi Arabia’s, are pegged to the U.S. dollar.

Saudi Arabia’s benchmark index advanced 1.2%, led by a 4.1% jump in Al Rajhi Bank and a 1.3% increase in oil giant Saudi Aramco.

Oil prices – a catalyst for the Gulf’s financial markets -climbed by more than 1% as top importer China flagged its first move toward a loosened monetary policy since 2010, aiming to bolster economic growth, state media reported citing a Politburo meeting.

Most Gulf markets gain on US rate cut bets, OPEC+ output delay

In Qatar, the index gained 0.6%, with the Gulf’s biggest lender Qatar National Bank finishing 1.3% higher.

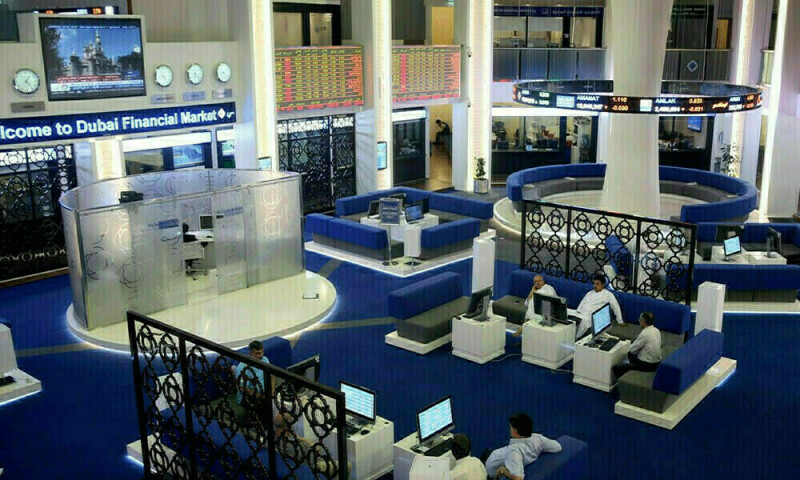

Dubai’s main share index eased 0.1%, hit by a 2% fall in blue-chip developer Emaar Properties.

The Abu Dhabi index was down 0.1%.

Outside the Gulf, Egypt’s blue-chip index lost 0.2%, weighed down by a 3.8% fall in E-Finance for Digital and Financial Investments.

--------------------------------------- SAUDI ARABIA leapt 1.2% to 12,097 ABU DHABI fell 0.2% to 9,251 DUBAI down 0.1% to 4,848 QATAR rose 0.6% to 10,421 EGYPT lost 0.2% to 31,005 BAHRAIN eased 0.3% to 2,029 OMAN added 0.1% to 4,553 KUWAIT gained 0.6% to 7,836 ---------------------------------------

Most stock markets in the Gulf closed higher on Monday as investors waited for a reading of U.S. inflation data later this week for insights into the Federal Reserve’s monetary policy path.

Fed officials appear on track to cut interest rates this month after data showed the U.S. labor market remained strong but continued to cool in November.

U.S. employers added 227,000 jobs last month, a rebound from a hurricane-related slowdown in October, but the unemployment rate inched up to 4.2%, the Labor Department’s monthly employment report showed on Friday.

According to the CME Group’s FedWatch Tool, markets currently see a roughly 85% chance of a 25-basis-point rate cut this month.

The Fed’s decisions impact monetary policy in the Gulf region where most currencies, including Saudi Arabia’s, are pegged to the U.S. dollar.

Saudi Arabia’s benchmark index advanced 1.2%, led by a 4.1% jump in Al Rajhi Bank and a 1.3% increase in oil giant Saudi Aramco.

Oil prices – a catalyst for the Gulf’s financial markets -climbed by more than 1% as top importer China flagged its first move toward a loosened monetary policy since 2010, aiming to bolster economic growth, state media reported citing a Politburo meeting.

Most Gulf markets gain on US rate cut bets, OPEC+ output delay

In Qatar, the index gained 0.6%, with the Gulf’s biggest lender Qatar National Bank finishing 1.3% higher.

Dubai’s main share index eased 0.1%, hit by a 2% fall in blue-chip developer Emaar Properties.

The Abu Dhabi index was down 0.1%.

Outside the Gulf, Egypt’s blue-chip index lost 0.2%, weighed down by a 3.8% fall in E-Finance for Digital and Financial Investments.

--------------------------------------- SAUDI ARABIA leapt 1.2% to 12,097 ABU DHABI fell 0.2% to 9,251 DUBAI down 0.1% to 4,848 QATAR rose 0.6% to 10,421 EGYPT lost 0.2% to 31,005 BAHRAIN eased 0.3% to 2,029 OMAN added 0.1% to 4,553 KUWAIT gained 0.6% to 7,836 ---------------------------------------