Most stock markets in the Gulf ended higher on Thursday following soft U.S. labour market data that buoyed investor expectations of interest rate cuts later this year.

Data on Wednesday showed signs of a weakening U.S. labour market, with unemployment claims increasing to 238,000, suggesting that the Fed could start cutting rates in September.

The chances of a September rate cut rose to 74% from 65% before the data, with markets pricing in 47 basis points of easing this year.

Monetary policy in the six-member Gulf Cooperation Council (GCC) is usually guided by the Fed’s decisions as most regional currencies are pegged to the U.S. dollar.

Saudi Arabia’s benchmark index gained 0.6%, led by a 2.9% rise in ACWA Power Company and a 0.6% increase in Al Rajhi Bank.

Among other gainers, oil giant Saudi Aramco finished 1.3% higher.

Most Gulf markets gain on US rate cut bets

Aramco and Abu Dhabi National Oil Company (ADNOC) have been separately considering bids for Australian gas producer Santos, Bloomberg News reported on Thursday, citing people with knowledge of the matter.

The Qatari benchmark added 0.2%, with Qatar Islamic Bank rising 0.8%.

In Abu Dhabi, the index closed 0.4% higher.

However, Emirates Telecommunications Group Company fell 1% after the Commercial Court Of Rabat directed Emirates Telecommunications’ subsidiary Maroc Telecom to pay 6.368 billion Moroccan dirham ($641.7 million) to Wana Corporate for alleged anti-competitive practices.

Dubai’s main share index fell 0.3%, snapping a six-session winning streak, hit by a 1% fall in blue-chip developer Emaar Properties and a 1.1% decrease in Salik Company.

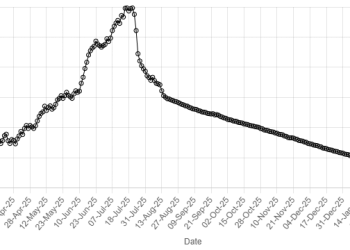

American Dollar Exchange Rate

American Dollar Exchange Rate