Most stock markets in the Gulf ended lower on Monday, as unexpectedly strong U.S. jobs data reinforced expectations of prolonged elevated interest rates in the world’s largest economy.

The hawkish jolt from the jobs data also raised the stakes for Wednesday’s consumer price figures where a core measure rise above the forecast of 0.2% could close the door on easing altogether.

Markets have already scaled back expectations for Federal Reserve rate cuts to just 27 basis points for all of 2025, with the Fed now expected to cut 100 basis points less than anticipated last year.

At least five Fed officials are on the docket to speak this week and offer their reaction to the jobs surprise, with the influential Federal Reserve Bank of New York President John Williams appearing on Wednesday.

Monetary policy in the six-member Gulf Cooperation Council (GCC) is usually guided by the Fed’s decisions as most regional currencies are pegged to the U.S. dollar.

Major Gulf markets mixed on strong US jobs data

Saudi Arabia’s benchmark index lost 0.1%, weighed down by a 1.8% decline in the Saudi Arabian Mining Company.

Separately, the kingdom plans to monetize all minerals, including by selling uranium, Saudi energy minister Prince Abdulaziz bin Salman said on Monday.

In Qatar, the index retreated 1.8%, as almost all its constituents were in negative territory, including the Gulf’s biggest lender Qatar National Bank (QNB), which was down 1.5%.

Post-trading hours, QNB posted a 10% rise in fourth-quarter net profit from a year earlier, slightly beating analyst estimates.

The Abu Dhabi index was down 0.4%.

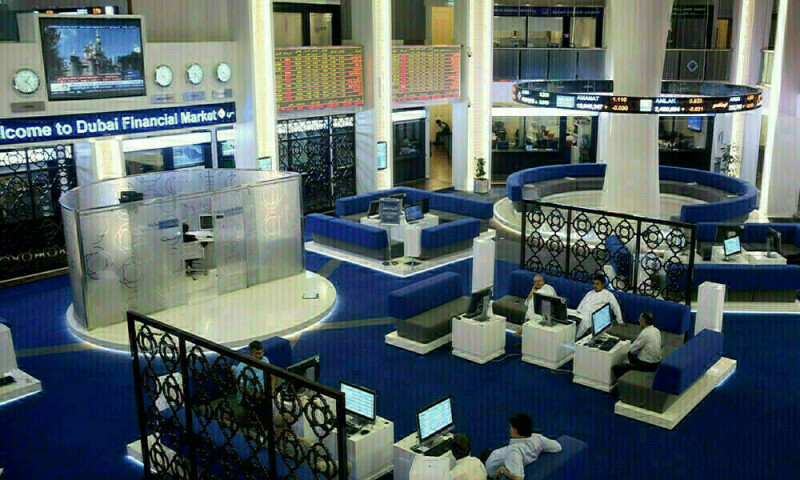

Dubai’s main share index edged 0.1% higher, helped by a 1.2% rise in top lender Emirates NBD.

Elsewhere, Aramex surged 14.7%, as Abu Dhabi sovereign wealth fund ADQ plans to launch a cash takeover offer, bidding for the shares it does not already own in the Dubai-listed courier firm.

Outside the Gulf, Egypt’s blue-chip index slid 2.5%, with Commercial International Bank losing 3.4%.

————————————–

SAUDI ARABIA down 0.1% to 12,292

Abu Dhabi fell 0.4% to 9,459

Dubai added 0.1% to 5,233

QATAR lost 1.8% to 10,220

EGYPT up 0.1% to 8,773

BAHRAIN down 2.6% to 1,919

OMAN was flat at 4,597

KUWAIT eased 0.3% to 7,973

————————————–