Most stock markets in the Gulf were little changed on Sunday with investors cautious over the potential implications of U.S. President Donald Trump’s plans to impose reciprocal tariffs.

President Trump has tasked his economics team with devising plans for reciprocal tariffs on every country that taxes U.S. imports, raising the risk of a global trade war.

Saudi Arabia’s benchmark index eased 0.1%, hit by a 5.4% drop in Saudi Research and Media Group.

Qatar’s index also eased 0.1%, with telecoms firm Ooredoo down 2%.

Meanwhile, data from the Federal Reserve showed factory output dipped 0.1% last month, against estimates for a 0.1% increase, after a downwardly revised 0.5% rebound in December, as a sharp drop in motor vehicle output weighed.

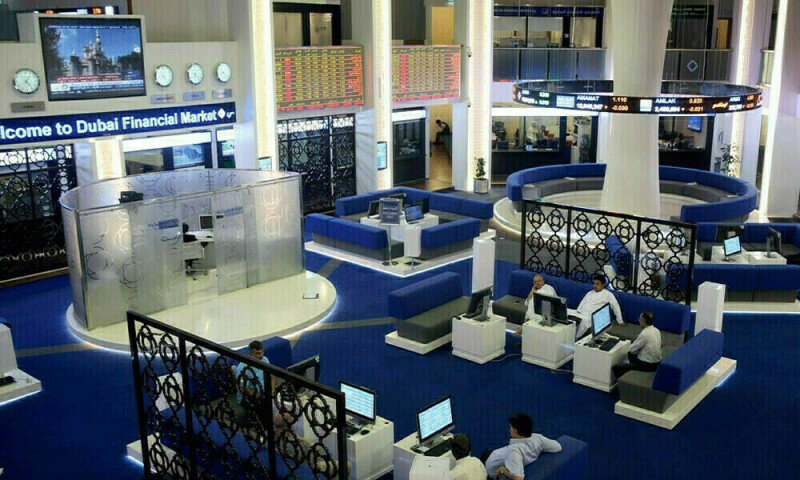

Dubai hits highest mark in nearly 11 years on strong corporate earnings

Dallas Fed President Lorie Logan on Friday reiterated her view that even if inflation data cools in coming months, the U.S. central bank should not necessarily reduce short-term borrowing costs in response.

The Fed’s decisions impact monetary policy in the Gulf, where most currencies, including the dirham, are pegged to the dollar.

Outside the Gulf, Egypt’s blue-chip index rose 1.5%, with most of its constituent stocks in positive territory, including a 3.1% gain for Egypt Aluminum Company.

Tobacco monopoly Eastern Company rose 0.6%, on higher quarterly profit.

SAUDI ARABIA fell 0.1% to 12,372

QATAR eased 0.1% to 10,605

EGYPT rose 1.5% to 30,444

BAHRAIN added 0.1% to 1,891

OMAN closed flat at 4,478

KUWAIT finished flat at 8,568

American Dollar Exchange Rate

American Dollar Exchange Rate