Most major stock markets in the Gulf slipped on Wednesday amid falling oil prices, with investors awaiting minutes of the U.S. Federal Reserve’s latest policy meeting for clues on the timing of a rate cut.

Oil prices, a catalyst for the Gulf’s financial markets, dropped for a third straight session, with Brent down 1% at $82.07 a barrel by 1310 GMT.

The Abu Dhabi benchmark index fell 0.4% to 8,973, its lowest level in more than two years with most of its constituents posting losses. The conglomerate Alpha Dhabi Holding declined 2.9% and Aldar Properties, the emirate’s largest developer, slid 3.6%.

Bayanat AI and Presight AI Holding lost 6.1% and 3.1% respectively.

Meanwhile, Bayanat and Presight’s parent company G42 and Microsoft said they will invest $1 billion in a data center in Kenya as part of its efforts to expand cloud-computing services in East Africa.

Dubai’s benchmark index slipped 0.4%, with tolls operator Salik Company falling 2.1% and Emirates NBD, the emirate’s largest bank, down 1.5%.

Gulf markets drop as political uncertainty rises

The Qatari benchmark index was down 0.1%, pressured by a 0.9% dip in Qatar National Bank, the region’s largest bank and a 1.4% decrease in United Development Company.

Saudi Arabia’s benchmark stock index rose 0.3% with Al Rajhi Bank, the world’s largest Islamic lender, advancing 1.3% and ACWA Power gaining 2.4%. Etihad Etisalat and Saudi Electricity, however, lost 2.7% and 3.2% respectively.

Investors are looking to the minutes from the Fed’s most recent policy meeting, due later on Wednesday, after multiple Fed officials said on Tuesday that it would be best for the central bank to exercise patience before starting to cut interest rates.

Most Gulf currencies are pegged to the dollar and any U.S. monetary policy change is usually followed by Saudi Arabia, the United Arab Emirates and Qatar.

Outside the Gulf, Egypt’s blue-chip index was steady, with Abu Qir Fertilizers down 2.9%, while Edita Food Industries climbed 7% after the snack food maker reported a 27% rise in first quarterly net profit.

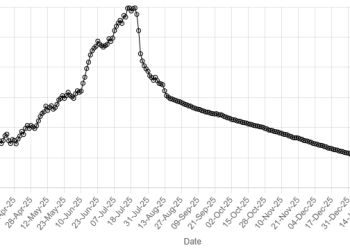

American Dollar Exchange Rate

American Dollar Exchange Rate