The Central Directorate of National Savings (CDNS) has increased profit rates on several of its National Savings Schemes.

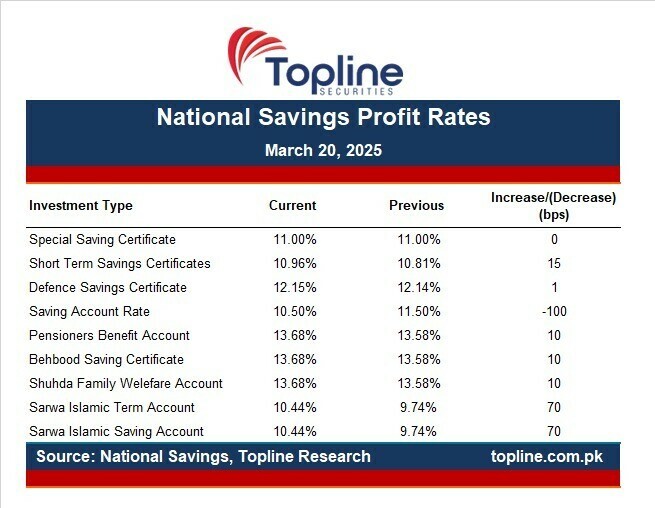

Rates of Short Term Saving Certificate (STSC) increased by 15 basis points (bps) to 10.96%, up from 10.81%. The Defence Saving Certificates (DSC) will offer a return of 12.15% return, as compared to 12.14% earlier, an increase of 1bps.

Similarly, the rate on the Pensioner Benefit Account, Behbood Savings Certificate and Shuhada Family Welfare Account inched up to 13.68% each, after an increase of 10bps.

Meanwhile, the rate offered by Sarwa Islamic Term Account (SITA) and Sarwa Islamic Saving Account (SISA) increased by 70bps to 10.44% each, up from 9.74%.

On the other hand, returns on Saving Account Rate lowered by 100bps, and will now offer returns of 10.5% as compared to 11.5%.

The National Savings Organization is Pakistan’s largest financial institution, managing a portfolio exceeding Rs3.4 trillion and serving over 4 million customers through a network of 376 branches across the country, administered by 12 Regional Directorates.

The CDNS helps the government finance budgetary deficits and support critical infrastructure projects.

The changes in profit returns follow the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) decision to maintain the policy rate stable at 12%.

Meanwhile, the CPI-based inflation clocked in at 1.5% in February 2025 on a YoY basis, as compared to 2.4% in the previous month, says the Pakistan Bureau of Statistics (PBS). This was the lowest in 113 months.