Muhammad Ali, the privatisation adviser to the prime minister, has ruled out an outright sale of the Roosevelt Hotel in New York, opting instead for a development-led privatisation strategy aimed at maximising value from the PIA asset.

“The 16-storey Roosevelt Hotel will be privatised through a joint-venture or redevelopment model rather than a direct sale,” he said, during an interview on Aaj News talk show Spot Light on Wednesday, adding that the government believes an immediate disposal would fail to realise the property’s full potential.

Ali said that a detailed study conducted last year concluded that the site could support a significantly taller structure, with development potential of up to 50–60 storeys.

“Under the proposed joint venture, the government would contribute the land while a private partner would inject around $1 billion in equity, with an additional $2–3 billion expected to be raised through debt financing.

“Following redevelopment, the government’s ownership stake would decline from 100% to roughly 40–50%, but the overall value of its holding is projected to increase by 200-250%,” he said.

Named after former US President Theodore Roosevelt, the century-old property in midtown Manhattan is seen as one of Pakistan’s most valuable foreign assets, which it acquired in 2000. Faced with mounting losses, the over 1,000-room hotel was shut in 2020, and has also operated briefly as a migrant shelter.

Chairman Privatisation Commission said there is already strong interest in the Roosevelt from major international players, including global commercial banks and IT firms seeking to develop their own premises at the site.

“Despite this demand, the government has chosen not to proceed with a direct sale,” he said.

In contrast, the Hotel Scribe in Paris—also transferred to the PIA holding company as part of the airline’s restructuring—will not be privatised at present, he shared.

“The government has decided to retain the asset for now, with no immediate plans to offer it for sale or development,” he said.

The privatisation process, a key benchmark of the International Monetary Fund (IMF), has picked up pace in recent months.

PIA to be run by new owners from April: privatisation chief

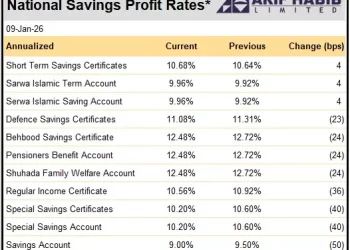

Last month, a consortium headed by the Arif Habib Corporation emerged as the top bidder in a live-televised auction for a 75% stake in PIA, marking a breakthrough for the government’s long-delayed privatisation of the carrier.

The Arif Habib consortium offered Rs135 billion ($482.14 million), surpassing a government reserve price of Rs100 billion, in a sharp turnaround from last year’s failed sale attempt.