Americans grew less worried about the near-term path of inflation and hiring in January, a report from the Federal Reserve Bank of New York said on Monday.

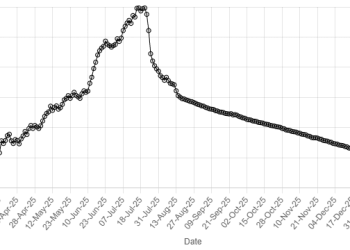

As part of its latest Survey of Consumer Expectations, the bank said that inflation expectations one year from now stood at 3.1% in January compared with 3.4% in December, while at the three- and five-year-ahead horizons, expectations held steady at 3%.

On the hiring front, some of the sour mood over labor market prospects abated in January. The survey found respondents see a lower chance of losing their job and an improved outlook for finding one if they did.

Households in January also reported that they saw higher earnings expectations in January relative to December, while the expected level of income a year from now ebbed last month compared with December.

Although households were more upbeat about hiring in general, they still collectively said they expect the unemployment rate to be higher a year from now compared to what they saw in December.

Fed set to keep rates steady

At the same time, survey respondents see credit as harder to get in the future, while downgrading the state of their current and future financial situations in January relative to the month before.

The retreat in near-term expected inflation is likely to be viewed as good news by Federal Reserve policymakers, who are continuing to navigate a challenging environment for price pressures.

The Fed trimmed its interest rate target range by 75 basis points last year to between 3.5% and 3.75%, as it sought to support a weakening job market while still imposing enough restraint on the economy to help lower inflation pressures. It held rates steady in January although some officials favored a cut.

Fed officials have been describing the job market as a low-hire, low-fire environment, and some policymakers say the cost of short-term credit needs to be eased to help ensure the hiring sector doesn’t run into deeper trouble.

Fed officials expect inflation to wane over the course of the year due to projections that tariff pressures will abate. Part of their confidence that inflation will return to target rests on the relative stability of longer-run inflation expectations.

Data suggests “the American people believe that we are committed to bringing inflation down to our target,” Federal Reserve Vice Chair Philip Jefferson said on Friday. “My view is that we are still perceived of as being credible now with respect to the current situation with inflation being above target,” and that inflation pressures will ease over time, he said.