TOKYO/SINGAPORE: Oil prices climbed on Thursday as investors weighed what impact the U.S.-Russia summit on Ukraine on Friday might have on Russian crude flows, with secondary sanctions looming over Moscow’s customers, while a rising supply outlook capped gains.

Brent crude futures rose 45 cents, or 0.7%, to $66.08 a barrel at 0631 GMT, while U.S. West Texas Intermediate crude futures gained 44 cents, also up 0.7%, to $63.09.

Both contracts hit their lowest in two months on Wednesday after bearish supply guidance from the U.S. government and the International Energy Agency (IEA).

Trump on Wednesday threatened “severe consequences” if Putin does not agree to peace in Ukraine. Trump did not specify whatthe consequences could be, but he has warned of economic sanctions if the meeting in Alaska on Friday proves fruitless.

“The uncertainty of U.S.-Russia peace talks continues to add a bullish risk premium given Russian oil buyers could face more economic pressure,” Rystad Energy said in a client note.

“How Ukraine-Russia crisis resolves and Russia flows change could bring some unexpected surprises.”

Trump has threatened to enact secondary tariffs on buyers of Russian crude, primarily China and India, if Russia continues with its war in Ukraine.

“Clearly there’s upside risk for the market if little progress is made” on a ceasefire,“ said Warren Patterson, head of commodities strategy at ING, in a note.

The expected oil surplus through the latter part of this year and 2026, combined with spare capacity from the Organization of the Petroleum Exporting Countries, means that the market should be able to manage the impact of secondary tariffs on India, Patterson said.

But things become more difficult if we see secondary tariffs on other key buyers of Russian crude oil, including China and Turkey, he said.

Expectations the U.S. Federal Reserve will cut rates in September are also supportive for oil. Traders are almost 100% agreed a cut will happen after U.S. inflation increased at a moderate pace in July.

Treasury Secretary Scott Bessent said he thought an aggressive half-point cut was possible given recent weak employment numbers.

The market is putting the odds of a quarter-percentage point cut at the Fed’s September 16-17 meeting at 99.9%, according to the CME FedWatch tool.

Lower borrowing rates would drive demand for oil.

Oil prices were kept in check as crude inventories in the United States unexpectedly rose by 3 million barrels in the week ended on August 8, according to the U.S. Energy Information Administration on Wednesday.

Also holding oil prices back was an International Energy Agency forecast that 2025 and 2026 global supply would rise more rapidly than expected, as OPEC and its allies increase output and production from outside the group grows.

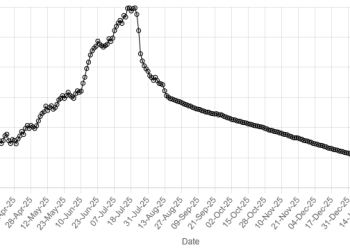

American Dollar Exchange Rate

American Dollar Exchange Rate