HOUSTON: Oil prices fell more than 1% on Tuesday as lingering U.S. inflation was poised to keep interest rates higher for longer, which could impact consumer demand at the pump.

Brent crude futures fell by $1.16, or 1.4%, to $82.55 a barrel by 11:45 a.m. ET (1545 GMT). U.S. West Texas Intermediate crude (WTI) futures for June, which are set to expire on Tuesday, slipped by 96 cents, or 1.2%, to $78.84.

The more active July contract lost $1.08, or 1.4%, to $78.22.

Both benchmarks fell by 1% on Monday after Federal Reserve officials said they were awaiting more signs of slowing inflation in the U.S. before considering interest rate cuts.

Higher borrowing costs tie up funds in a blow to economic growth and demand for crude, as well as pressuring consumer demand at the pump.

“The market is very focused on gasoline demand in the U.S. because there are signs that consumers are cutting back because of inflation. Unless that turns around, the market is suggesting things could be a little bleak”, said Phil Flynn, an analyst at Price Futures Group.

Oil steadies after death of Iran’s president, Saudi king’s ill health

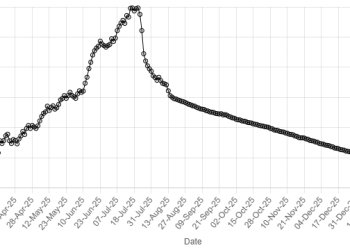

Despite the run up to this weekend’s Memorial Day holiday, which kicks off the U.S. peak summer driving season, retail gasoline prices fell for the fourth straight week to $3.58 per gallon on Monday, the Energy Information Administration (EIA) said in its gasoline and diesel fuel update.

Meanwhile, Fed officials’ comments pointed to interest rates staying higher for longer than markets previously expected.

Fed Vice Chair Philip Jefferson said it was too early to tell whether the inflation slowdown is long lasting while Vice Chair Michael Barr said restrictive policy needs more time. Atlanta Fed President Raphael Bostic said it will “take a while” for the central bank to be confident that a price growth slowdown is sustainable.

Investors are awaiting minutes from the Fed’s last policy meeting due on Wednesday, as well as weekly U.S. oil inventory data. Industry oil data is due at 4:30 p.m. ET on Tuesday, followed by the EIA’s report on Wednesday.

On the supply side, a fading geopolitical risk premium from the ongoing war in Gaza failed to provide much support.

American Dollar Exchange Rate

American Dollar Exchange Rate