TOKYO: Oil prices rose on Thursday, pausing a five-day losing streak, on signs of steady demand in the U.S., the world’s biggest oil user, though the prospect of U.S.-Russian talks on the Ukraine war eased concerns of supply disruptions from further sanctions.

Brent crude futures rose 20 cents, or 0.3%, to $67.09 a barrel by 0039 GMT while U.S. West Texas Intermediate crude was at $64.57 a barrel, up 22 cents, or 0.3%.

Both benchmarks slid about 1% to their lowest in eight weeks on Wednesday after U.S. President Donald Trump’s remarks about progress in talks with Moscow.

Trump could meet with Russian President Vladimir Putin as soon as next week, a White House official said on Wednesday, though the U.S. continued preparations to impose secondary sanctions, including potentially on China, to pressure Moscow to end the war in Ukraine.

Russia is the world’s second-biggest producer of crude after the U.S.

Still, oil markets were supported from a bigger-than-expected draw in U.S. crude inventories last week.

The Energy Information Administration said on Wednesday that U.S. crude oil stockpiles fell by 3 million barrels to 423.7 million barrels in the week ended August 1, exceeding analysts’ expectations in a Reuters poll for a 591,000-barrel draw.

Inventories fell as U.S. crude exports climbed and refinery runs climbed, with utilization on the Gulf Coast, the country’s biggest refining region, and the West Coast climbing to their highest since 2023.

But the unsettled nature of the talks and the overall supply and demand situation with major producers increasing their output has made investors cautious, said Hiroyuki Kikukawa, chief strategist of Nissan Securities Investment, a unit of Nissan Securities.

“Uncertainty over the outcome of the US-Russia summit, possible additional tariffs on India and China – key buyers of Russian crude – and the broader impact of U.S. tariffs on the global economy are prompting investors to stay on the sidelines,” said Kikukawa.

“With planned OPEC+’s output increases weighing on prices, WTI will likely remain in the $60-$70 range for the rest of the month,” he said, referring to the Organization of the Petroleum Exporting Countries and its allies including Russia.

Adding to the pressure on Russian oil buyers, Trump on Wednesday imposed an additional 25% tariff on Indian goods, citing their continued imports of Russian oil. The new import tax will go into effect 21 days after August 7.

Trump also said he could announce further tariffs on China similar to the 25% duties announced earlier on India over its purchases of Russian oil.

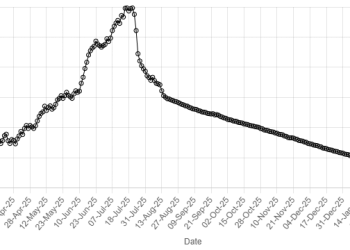

American Dollar Exchange Rate

American Dollar Exchange Rate