NEW DELHI: Oil prices slipped in Asian trading on Monday after a survey on Friday showed weaker U.S. consumer demand and as May crude production rose in China, the world’s biggest crude importer.

Global benchmark Brent crude futures for August delivery were down 40 cents, or 0.5%, at $82.22 per barrel at 0631 GMT. U.S. West Texas Intermediate crude futures for July delivery fell 36 cents to $78.09 a barrel.

The more-active August delivery WTI contract slipped 0.5% to $77.7 per barrel.

That followed prices slipping on Friday after a survey showed U.S. consumer sentiment fell to a seven-month low in June, with households worried about their personal finances and inflation.

However, both benchmark contracts still gained nearly 4% last week, the highest weekly rise in percentage terms since April, on signs of stronger fuel demand.

“Last week’s robust rally was fuelled by forecasts of strong 2024 demand from OPEC+ and the IEA. However, given OPEC’s vested

interest in crude oil, there is some scepticism around OPEC’s forecasts,” said Tony Sycamore, a market analyst at IG in Singapore.

Oil prices set for best week in two months on demand outlook

“Friday’s soft U.S. consumer confidence numbers suggest that

the resilience of the American consumer and the U.S. economy

will be tested as households run down their savings to combat

higher interest rates and cost-of-living pressures,” he added.

Meanwhile, China’s May domestic crude oil production rose 0.6% on year to 18.15 million tons, according to data released by the National Bureau of Statistics on Monday.

Year-to-date output was 89.1 million tons, up 1.8% from a year earlier. National crude oil throughput fell 1.8% in May over the same year-ago level to 60.52 million tons, with year-to-date totalling 301.77 million tons, up 0.3% from a year ago.

The country’s May industrial output lagged expectations and

a slowdown in the property sector showed no signs of easing,

adding pressure on Beijing to shore up growth.

The flurry of data on Monday was largely downbeat, underscoring a bumpy recovery for the world’s second-largest

economy.

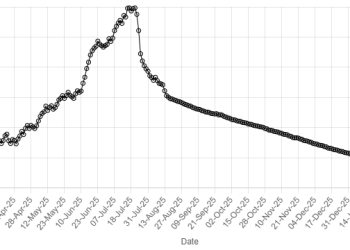

American Dollar Exchange Rate

American Dollar Exchange Rate