LONDON: Oil prices slipped on Thursday as investors digested that the U.S. Federal Reserve had likely pushed back an interest rate cut to December and as U.S. crude and fuel stocks rose.

Brent crude futures fell 60 cents, or 0.7%, to $82 a barrel by 1207 GMT. West Texas Intermediate (WTI) U.S. crude futures fell 68 cents, or 0.9%, to $77.82. Both benchmarks had gained nearly 1% in the previous session.

The Fed held rates steady on Wednesday and pushed out the start of policy easing to perhaps as late as December.

“In the Fed’s view this is the price that needs to be paid to achieve a soft landing and avoid recession beyond doubt,” PVM Oil analyst Tamas Varga said.

Higher borrowing costs tend to dampen economic growth, and can by extension, limit oil demand.

Fed Chair Jerome Powell said in a press conference after the U.S. central bank’s two-day policy meeting that inflation had fallen without a major blow to the economy, adding that there was no reason to think that cannot go on.

On the supply side, U.S. crude stockpiles rose more than expected last week, driven largely by a jump in imports, while fuel inventories also increased more than anticipated, data from the Energy Information Administration showed on Wednesday.

Oil little changed as surprise crude stock build caps gains

Also weighing on prices was a bearish report by the International Energy Agency, which warned of excess supply in the near future.

Traders are also watching ongoing talks for a ceasefire in Gaza, which, if resolved, would reduce fears of potential oil supply disruptions from the region.

In the latest attack on shipping, Iran-allied Houthi militants on Wednesday took responsibility for an attack by small craft and missiles that left a Greek-owned coal carrier in need of rescue near Yemen’s Red Sea port of Hodeidah.

The militant group has attacked international shipping in the Red Sea region since November in solidarity with the Palestinians in the war between Israel and Hamas.

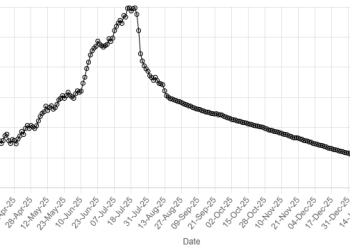

American Dollar Exchange Rate

American Dollar Exchange Rate