LONDON: Oil prices were largely steady on Tuesday, as investors waited for U.S. and China inflation data and the outcome of the Federal Reserve’s policy meeting to see how changing prices could hit demand.

Brent crude futures fell 14 cents, or 0.2%, to $81.49 per barrel by 1121 GMT, easing after a recovery from a close of $77.52 a week earlier. That close, the lowest since February, came as investors fretted about oversupply and low demand through the rest of 2024.

U.S. West Texas Intermediate (WTI) crude futures slipped 18 cents, or 0.2%, to $77.56.

Prices had climbed about 3% to a one-week high on Monday, buoyed by expectations that the Northern Hemisphere summer vacation season will boost fuel demand this summer. Some analysts said the gain was likely to be short-lived given the prospect of higher interest rates remaining due to stronger-than-desired inflation.

The release of U.S. consumer price index data for May and the conclusion of the Fed’s two-day policy meeting are both scheduled for Wednesday.

“More conviction may be needed in oil prices for a more sustained recovery with a move above the $83.00 level, given that the broader trend for oil prices still leans on the downside with a series of higher highs since April,” IG market strategist Yeap Jun Rong said.

US crude output rises in March

Traders were also cautious ahead of the release of macroeconomic data from China on Wednesday.

“The potential adverse macro driver for oil prices will be China’s inflation data that will be out tomorrow,” said OANDA senior market analyst Kelvin Wong.

Wong said that if China’s Producer Price Index disappoints by falling 2% year on year or more, “it suggests that the deflationary risk spiral remains entrenched in China which in turn may likely see less demand for oil.”

Deflation can see purchases dry up as businesses and consumers expect to pay less later as prices fall, hitting economic activity and dampening oil demand.

Meanwhile, falling Saudi crude exports to China for a third straight month also put further pressure on prices.

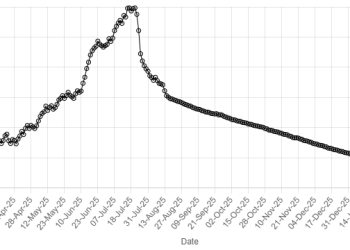

American Dollar Exchange Rate

American Dollar Exchange Rate