KARACHI: Pakistan’s central bank is expected to retain interest rates at 11% on Monday, a Reuters poll showed, as analysts push back rate-cut forecasts to late 2026 after the IMF warned inflation risks persist and policy must stay “appropriately tight”.

All 12 analysts surveyed expect no cut in the policy meeting on Monday. A majority of them see inflation hovering at 6%–8% in the coming months before rising again toward the end of fiscal 2026 as base effects fade and food and transport prices stay volatile after flood-related supply disruptions.

Most respondents now believe the State Bank of Pakistan (SBP) will not begin easing until the closing months of FY26, which ends in June 2026, with some analysts pushing forecasts for the first cut into fiscal year 2027, beginning July 2026.

IMF warns against premature easing

The IMF, in a second review released on Thursday, said monetary policy needs to remain “appropriately tight and data-dependent” to keep expectations anchored and noted that the SBP had maintained positive real interest rates on a forward-looking basis.

It said the tight stance had been pivotal in reducing inflation and should be maintained to ensure price stability and support the rebuilding of external buffers.

Analysts said these risks, along with the SBP’s preference for maintaining positive real interest rates, would keep policymakers cautious.

Banks, DFIs must align policies with green taxonomy: SBP

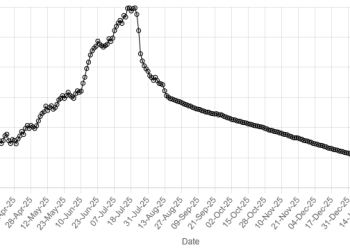

The SBP has held its policy rate at 11% since September, after cutting it by 1,100 basis points between June 2024 and May 2025 as inflation fell sharply from highs near 40% in 2023.

Price, external pressures edge up

Inflation has started to accelerate after months of decline, driven by food and transport costs and fading base effects.

Headline inflation eased to 6.1% in November from 6.2% in October but remained above the SBP’s 5–7% target.

The IMF expects inflation to temporarily accelerate to 8%–10% this fiscal year before stabilising.

While Pakistan’s macroeconomic backdrop has stabilised somewhat, analysts said the recovery remains sensitive to external pressures.

Premature rate cuts could pressure the rupee even with anticipated IMF inflows, including $1.2 billion disbursement this week to bolster reserves and support climate-resilience reforms.

Any demand-driven uptick, said Sana Tawfik, head of research at Arif Habib Ltd, “will have an adverse impact on the external front”.

American Dollar Exchange Rate

American Dollar Exchange Rate