Pakistan is ranked among the least resilient nations in the Global Investment Risk and Resilience Index by Henley & Partners, highlighting persistent challenges in economic stability, governance, and investor confidence.

The development comes a week after Pakistan’s passport was ranked among the world’s weakest, retaining its position as the fourth worst globally for the fifth consecutive year in the Henley Passport Index.

Developed by global residence and citizenship advisory firm Henley & Partners in partnership with the AI-powered analytics platform AlphaGeo, the index provides investors, families, and governments with a systematic framework to navigate a world of overlapping risks – from geopolitical conflict and inflation to technological disruption and climate change.

“By combining risk exposure and resilience capacity into a single score, it [index] identifies the countries that are best placed to preserve wealth and generate long-term value, helping investors, businesses, and families construct a better global risk profile to thrive amid uncertainty while giving governments a benchmark to measure competitiveness,” the advisory firm said in a press release.

Switzerland has been ranked 1st worldwide, driven by “exceptionally low risk and world-leading innovation, governance, and social metrics”.

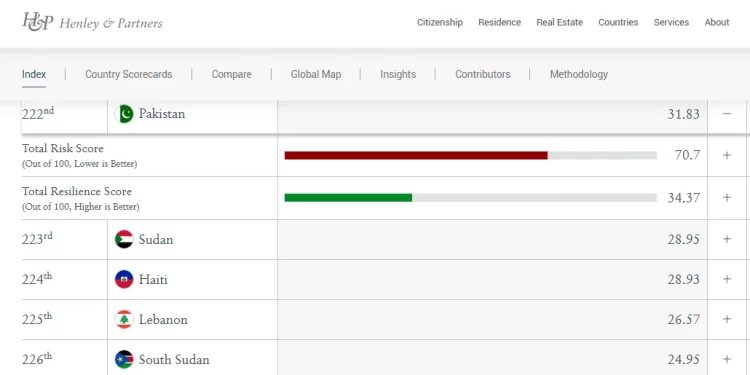

South Sudan (226th), Lebanon (225th), Haiti (224th), Sudan (223rd), and Pakistan (222nd) sit at the bottom of the index.

“Significant political instability and considerable legal and regulatory risks underpin their [the countries including Pakistan] high-risk profiles. Weak governance, limited innovation and economic complexity, and low social development further constrain their resilience, reflecting entrenched instability and minimal adaptive capacity.”

Close behind Switzerland, the Nordic countries of Denmark (2nd), Norway (3rd), and Sweden (5th) exemplify how “equitable growth, robust institutions, and forward-looking social policy create world-leading resilience”.

Singapore takes 4th place in the index with the lowest legal and regulatory risk globally.

The index is the first of its kind to measure countries’ exposure to geopolitical, economic, and climate risks as well as their capacity to adapt and recover, revealing how resilience is increasingly concentrated in smaller, highly adaptive states.

Dr Christian H. Kaelin, Chairman of Henley & Partners, said he was pleased with his firm’s latest research and global barometer for measuring complex risks.

“This index is a new, useful tool in understanding where true sovereign risks and resilience lie. For investors, companies, and global citizens, it offers unprecedented clarity on where to place confidence and capital in the years ahead,“ he was quoted as saying in the press release.

“Resilience now matters more than wealth or political structure as the true driver of future success as we have entered a more volatile phase of history. For nations, it underpins lasting prosperity. For investors and global families, it offers both protection and a powerful engine for long-term value creation.”

Pakistan’s economy is currently supported by the International Monetary Fund (IMF) $7 billion loan programme and deposits from friendly countries, which have helped the country’s central bank foreign exchange (FX) reserves surging to $14.44 billion as of October 10, 2025 from less than $3 billion in early 2023. The workers remittances have also played their role in sustaining growth in the FX reserves.

The country has shown some signs of stabilisation recently, but it has yet to transition to a sustainable growth phase.

Despite gains in FX reserves, remittances, and being under the umbrella of an IMF programme, growth remains a major issue for the import-based South Asian country.

Pakistan has to increase exports, create import substitution, and attract Foreign Direct Investment (FDI) in export-based projects to achieve sustainable growth to the level it provides job opportunities to majority new comers in the job market and control the rising poverty in the country.

Though the balance of current account has surprisingly returned into surplus in September 2025, the flood and post-flood reconstruction spending carries high risk of increasing twin – trade and current account – deficits and inflation reading above the projected 7% in the fiscal year 2025-26.

American Dollar Exchange Rate

American Dollar Exchange Rate