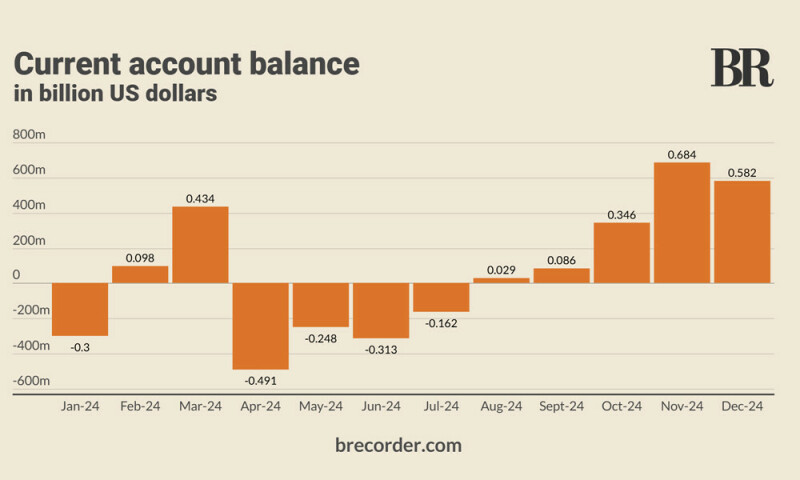

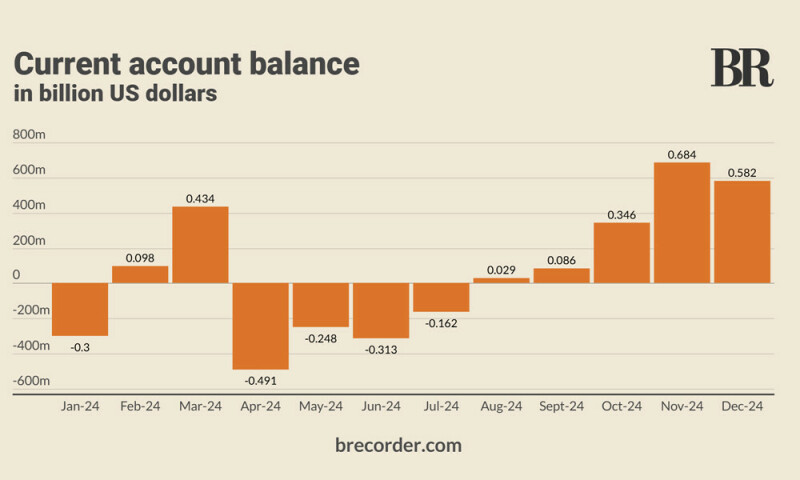

Pakistan’s current account posted a surplus of $582 million in December 2024, a massive jump of 109% when compared with the surplus of $279 million in the same month of the previous year, data released on Friday by the State Bank of Pakistan (SBP) showed.

This is the fifth consecutive month of a current account surplus.

Brokerage house Topline Securities stated that Pakistan’s surplus of $582 million for December “came higher than expectations”. It attributed the surplus to “higher remittances and improved trade balance”.

Meanwhile, for November, the surplus was originally reported to be at $729 million, but the SBP revised it in the latest data to be at $684 million.

Overall, the figure takes Pakistan’s current account to a surplus of $1.21 billion in the first half of the current fiscal year (1HFY25), in stark contrast to a massive deficit of $1.397 billion in the same period of the previous fiscal year.

Breakdown

In December 2024, the country’s total export of goods and services amounted to $3.838 billion, up nearly 9% as compared to $3.53 billion in the same month of the previous year

Meanwhile, imports clocked in at $5.781 billion during December 2024, an increase of over 15% on a yearly basis, according to SBP data.

Workers’ remittances clocked in at $3.079 billion, an increase of over 29% as compared to the previous year.

Low economic growth along with high inflation have helped curtail Pakistan’s current account deficit with an increase in exports also helping the cause. A high interest rate, which has declined in recent months, and some restrictions on imports have also aided the policymakers’ objective of a narrower current account deficit.

1HFY25

In 1HFY25, the country’s total export of goods and services amounted to $20.28 billion. Whereas, imports clocked in at $33.38 billion during the period, according to SBP data.

The country’s worker remittances clocked in at $17.85 billion, an increase of nearly 33% compared to $13.44 billion in the same period last year.

The current account is a key figure for cash-strapped Pakistan which relies heavily on imports to run its economy.

A widening deficit puts pressure on the exchange rate and drains official foreign exchange reserves, while the situation reverses vice versa.

Pakistan’s current account posted a surplus of $582 million in December 2024, a massive jump of 109% when compared with the surplus of $279 million in the same month of the previous year, data released on Friday by the State Bank of Pakistan (SBP) showed.

This is the fifth consecutive month of a current account surplus.

Brokerage house Topline Securities stated that Pakistan’s surplus of $582 million for December “came higher than expectations”. It attributed the surplus to “higher remittances and improved trade balance”.

Meanwhile, for November, the surplus was originally reported to be at $729 million, but the SBP revised it in the latest data to be at $684 million.

Overall, the figure takes Pakistan’s current account to a surplus of $1.21 billion in the first half of the current fiscal year (1HFY25), in stark contrast to a massive deficit of $1.397 billion in the same period of the previous fiscal year.

Breakdown

In December 2024, the country’s total export of goods and services amounted to $3.838 billion, up nearly 9% as compared to $3.53 billion in the same month of the previous year

Meanwhile, imports clocked in at $5.781 billion during December 2024, an increase of over 15% on a yearly basis, according to SBP data.

Workers’ remittances clocked in at $3.079 billion, an increase of over 29% as compared to the previous year.

Low economic growth along with high inflation have helped curtail Pakistan’s current account deficit with an increase in exports also helping the cause. A high interest rate, which has declined in recent months, and some restrictions on imports have also aided the policymakers’ objective of a narrower current account deficit.

1HFY25

In 1HFY25, the country’s total export of goods and services amounted to $20.28 billion. Whereas, imports clocked in at $33.38 billion during the period, according to SBP data.

The country’s worker remittances clocked in at $17.85 billion, an increase of nearly 33% compared to $13.44 billion in the same period last year.

The current account is a key figure for cash-strapped Pakistan which relies heavily on imports to run its economy.

A widening deficit puts pressure on the exchange rate and drains official foreign exchange reserves, while the situation reverses vice versa.