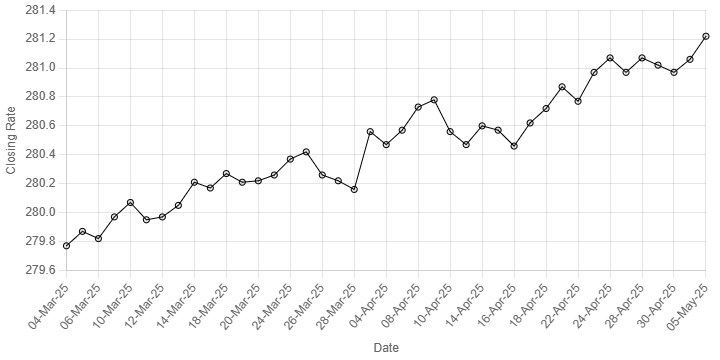

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted a marginal decline against the US dollar, depreciating 0.06% in the inter-bank market during trading on Monday .

At close, the local currency settled at 281.22, a loss of Re0.16 against the greenback.

During the previous week, the Pakistani rupee depreciated further against the US dollar in the inter-bank market as it lost Re0.09 or 0.03%.

The local unit closed at Rs281.06, against Rs280.97 it had closed at during the week earlier, according to the State Bank of Pakistan (SBP).

Globally, the US dollar was struggling to hold its ground on Monday, even as concerns about a US recession eased just a little, while investors awaited actual evidence of a thaw in Sino-US trade relations, as opposed to just hints from officials.

The solid March payrolls report had offered the dollar support by lengthening the odds on a Federal Reserve rate cut in June, and making it more likely the central bank will lean hawkish at its policy meeting this week.

Markets now imply only a 37% chance of a Fed cut in June, down from 64% a month ago. Goldman Sachs and Barclays both shifted their cut calls to July from June.

US dollar still down, but off lows

Yet it was notable that the US dollar had only got a limited lift from the jobs data and was having trouble keeping the gains, with turnover in Asia thinned by holidays in Japan and China.

The US dollar also eased 0.2% to 144.63 yen , and away from Friday’s top around 145.91.

Speculation that the Trump administration was pressuring Asian countries to strengthen their currencies versus the dollar saw the Taiwanese dollar surge more than 5% last Friday.

Oil prices, a key indicator of currency parity, fell more than $2 a barrel in early Asian trade on Monday as OPEC+ is set to further speed up oil output hikes, spurring concerns about more supply.

Brent crude futures dropped $2.04 a barrel, or 3.33%, to $59.25 a barrel by 2240 GMT while U.S. West Texas Intermediate crude was at $56.19 a barrel, down $2.10, or 3.60%.

Both contracts touched their lowest since April 9 at Monday’s open after OPEC+ agreed to accelerate oil production hikes for a second consecutive month, raising output in June by 411,000 barrels per day (bpd).

Inter-bank market rates for dollar on Monday

BID Rs 281.25

OFFER Rs 281.45

Open-market movement

In the open market, the PKR lost 3 paise for buying and 1 paisa for selling against USD, closing at 281.46 and 282.90, respectively.

Against Euro, the PKR lost 17 paise for buying and 30 paise for selling, closing at 318.62 and 321.66, respectively.

Against UAE Dirham, the PKR lost 1 paise for buying and 4 paise for

selling, closing at 76.52 and 77.13, respectively.

Against Saudi Riyal, the PKR gained 4 paise for buying and remained unchanged for selling, closing at 75.10 and 75.70, respectively.

Open-market rates for dollar on Monday

BID Rs 281.46

OFFER Rs 282.90

American Dollar Exchange Rate

American Dollar Exchange Rate