Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”, “03-Jul-25”, “04-Jul-25”, “07-Jul-25”, “08-Jul-25”, “09-Jul-25”, “10-Jul-25”, “11-Jul-25”, “14-Jul-25”, “15-Jul-25”, “16-Jul-25”, “17-Jul-25”, “18-Jul-25”, “21-Jul-25”, “22-Jul-25”, “23-Jul-25”, “24-Jul-25”, “25-Jul-25”, “28-Jul-25”, “29-Jul-25”, “30-Jul-25”, “31-Jul-25”, “01-Aug-25”, “04-Aug-25”, “05-Aug-25”, “06-Aug-25”, “07-Aug-25”, “08-Aug-25”, “11-Aug-25”, “12-Aug-25”, “13-Aug-25”, “15-Aug-25”, “18-Aug-25”, “19-Aug-25”, “20-Aug-25”, “21-Aug-25”, “22-Aug-25”, “25-Aug-25”, “26-Aug-25”, “27-Aug-25”, “28-Aug-25”, “29-Aug-25”, “01-Sep-25”, “02-Sep-25”, “03-Sep-25”, “04-Sep-25”, “05-Sep-25”, “08-Sep-25”, “09-Sep-25”, “10-Sep-25”, “11-Sep-25”, “12-Sep-25”, “15-Sep-25”, “16-Sep-25”, “17-Sep-25”, “18-Sep-25”, “19-Sep-25”, “21-Sep-25”, “22-Sep-25”, “23-Sep-25”, “24-Sep-25”, “25-Sep-25”, “26-Sep-25”, “29-Sep-25”, “30-Sep-25”, “01-Oct-25”, “02-Oct-25”, “03-Oct-25”, “06-Oct-25”, “07-Oct-25”, “08-Oct-25”, “09-Oct-25”, “10-Oct-25”, “13-Oct-25”, “14-Oct-25”, “15-Oct-25”, “16-Oct-25”, “17-Oct-25”, “20-Oct-25”, “21-Oct-25”, “22-Oct-25”, “23-Oct-25”, “24-Oct-25”, “27-Oct-25”, “28-Oct-25”, “29-Oct-25”, “30-Oct-25”, “31-Oct-25”, “03-Nov-25”, “04-Nov-25”, “05-Nov-25”, “06-Nov-25”, “07-Nov-25”, “10-Nov-25”, “11-Nov-25”, “12-Nov-25”, “13-Nov-25”, “14-Nov-25”, “17-Nov-25”, “18-Nov-25”, “19-Nov-25”, “20-Nov-25”, “21-Nov-25”, “24-Nov-25”, “25-Nov-25”, “26-Nov-25”, “27-Nov-25”, “28-Nov-25”, “01-Dec-25”, “02-Dec-25”, “03-Dec-25”, “04-Dec-25”, “05-Dec-25”, “08-Dec-25”, “09-Dec-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95, 283.86, 283.97, 284.22, 284.36, 284.47, 284.56, 284.46, 284.72, 284.67, 284.96, 284.97, 284.87, 284.95, 284.97, 284.76, 284.22, 283.45, 283.21, 283.05, 282.95, 282.87, 282.72, 282.66, 282.57, 282.67, 282.56, 282.47, 282.45, 282.42, 282.22, 282.06, 282.01, 281.96, 281.95, 281.92, 281.90, 281.87, 281.86, 281.83, 281.8, 281.77, 281.75, 281.72, 281.71, 281.67, 281.65, 281.62, 281.61, 281.60, 281.56, 281.55, 281.52, 281.51, 281.50, 281.47, 281.46, 281.45, 281.46, 281.42, 281.43, 281.41, 281.37, 281.35, 281.32, 281.31, 281.27, 281.26, 281.25, 281.22, 281.21, 281.20, 281.17, 281.16, 281.15, 281.12, 281.11, 281.10, 281.07, 281.06, 281.05, 281.03, 281.02, 281.01, 280.97, 280.96, 280.92, 280.91, 280.90, 280.87, 280.86, 280.85, 280.82, 280.81, 280.78, 280.77, 280.76, 280.72, 280.71, 280.67, 280.66, 280.66, 280.65, 280.62, 280.61, 280.57, 280.56, 280.55, 280.52, 280.51, 280.47, 280.46, 280.45, 280.42, 280.41, 280.40

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

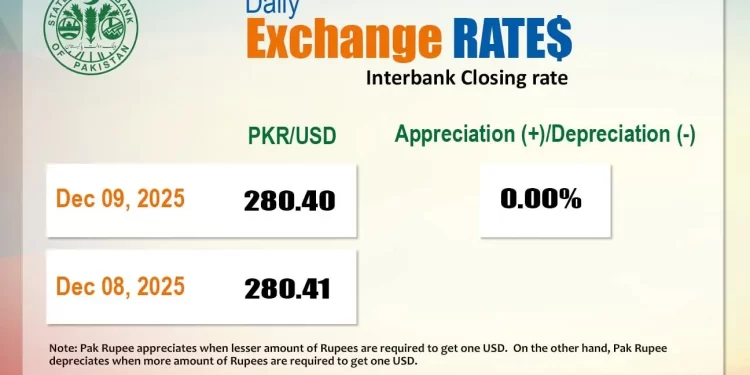

The Pakistani rupee saw marginal improvement against the US dollar in the inter-bank market on Tuesday.

At close, the local currency settled at 280.40, a gain of Re0.01 against the greenback.

On Monday, the local unit closed at 280.41.

The International Monetary Fund’s (IMF) Executive Board on Monday approved the disbursement of $1.2 billion for Pakistan under the Extended Fund Facility (EFF) and the Resilience and Sustainability Facility (RSF). The clearance unlocked about $1.2 billion, $1 billion under the EFF and $200 million through the RSF.

Finance Minister Muhammad Aurangzeb on Tuesday said that Pakistan’s successful completion of key reviews under the IMF programme reflected the country’s strengthened economic position and resilience, despite challenges posed by recent devastating floods.

Globally, the Japanese yen held steady in early Asian trading after a powerful 7.5-magnitude earthquake struck Japan’s northeast overnight, adding to a risk-off mood ahead of several policy decisions from central banks, including the Federal Reserve.

Against the yen, the US dollar was last flat at 155.885 yen after the quake, which prompted evacuation orders and tsunami warnings that were downgraded to advisories hours later.

Markets are preparing for a busy week of central bank decisions, anticipating a rate cut from the Federal Reserve at its meeting later this week.

The US dollar index, which measures the greenback’s strength against a basket of six currencies, was last up 0.1% at 99.092, edging back from its highest level in a week.

Bond investors are dialling back expectations of rate cuts in 2026 as scepticism mounts that Kevin Hassett, the frontrunner to succeed Jerome Powell, whose eight-year term as Fed chair ends in May, will prove as dovish as hoped by US President Donald Trump.

Nevertheless, markets believe policy easing from the U.S. central bank this week is a near-certainty, with attention turning to the outlook for the year ahead.

Fed funds futures are pricing an implied 87% probability of a 25-basis-point cut at the Fed’s December 9-10 policy meeting, according to the CME Group’s FedWatch tool.

Oil prices, a key indicator of currency parity, steadied on Tuesday after falling 2% in the previous session, with investors keeping a close eye on peace talks to end Russia’s war in Ukraine, concerns about ample supply and a looming decision on U.S. interest rates.

Brent crude futures edged 3 cents higher to $62.52 a barrel at 1317 GMT. US West Texas Intermediate crude gained 4 cents at $58.92 a barrel.

Inter-bank market rates for dollar on Tuesday

BID Rs 280.40

OFFER Rs 280.60

Open-market movement

In the open market, the PKR lost 1 paisa for buying and remained unchanged for selling against USD, closing at 280.88 and 281.45, respectively.

Against Euro, the PKR gained 12 paise for buying and 21 paise for selling, closing at 326.54 and 329.35, respectively.

Against UAE Dirham, the PKR lost 1 paisa for buying and gained 1 paisa for selling, closing at 76.55 and 77.29, respectively.

Against Saudi Riyal, the PKR gained 1 paisa for buying and 6 paise for selling, closing at 74.80 and 75.38, respectively.

Open-market rates for dollar on Tuesday

BID Rs 280.88

OFFER Rs 281.45