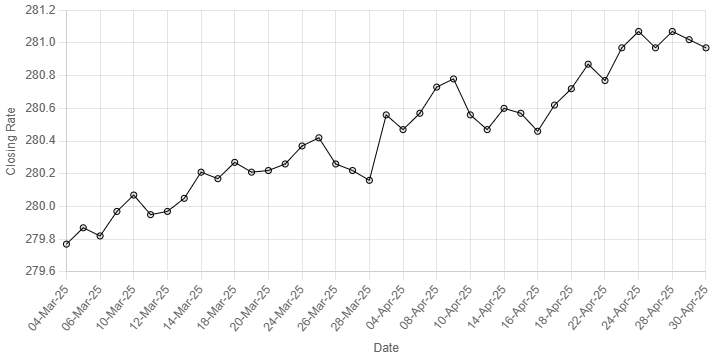

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal gain against the US dollar, appreciating by 0.02% during trading in the inter-bank market on Wednesday.

At close, the local currency settled at 280.97 against the greenback.

On Tuesday, the rupee had closed the day at 281.02.

Internationally, the US dollar was steady on Wednesday but poised for its weakest monthly performance since November 2022 as erratic US trade policies under President Donald Trump left the greenback vulnerable while boosting the euro, yen and Swiss franc.

The White House has retreated several times on the sweeping tariffs Trump unveiled in early April that led to a global stock market meltdown and prompted investors to flee the normally safe-haven U.S. dollar and Treasury debt.

Trump signed a pair of orders on Tuesday to soften the blow of his auto tariffs with a mix of credits and relief from other levies on materials.

Trump’s trade team also touted its first deal with a foreign trading partner, while US Treasury Secretary Scott Bessent said the administration is making progress on tariff negotiations, noting that deals are forthcoming for India and South Korea.

The developments helped ease some tensions as investors and companies worry about the economic fallout of the tariffs, with indications the duties will weigh on growth and could drive up inflation and unemployment.

Oil prices, a key indicator of currency parity, extended declines on Wednesday and were set for their largest monthly drop in almost three and a half years as the global trade war eroded the outlook for fuel demand, while concerns over mounting supply also weighed.

Retracing some earlier losses, Brent crude futures were down 63 cents, or 1%, at $63.62 per barrel by 1159 GMT. U.S. West Texas Intermediate crude futures dropped 42 cents, or 0.7%, to $60.00 a barrel.

So far this month, Brent and WTI have lost around 15% and 16%, respectively, the biggest percentage drops since November 2021.

Both benchmarks slumped after U.S. President Donald Trump’s April 2 announcement of tariffs on all U.S. imports. They then sank further to four-year lows as China responded with levies, stoking a trade war between the top two oil-consuming nations.

Inter-bank market rates for dollar on Wednesday

BID Rs 280.97

OFFER Rs 281.17

Open-market movement

In the open market, the PKR lost 10 paise for buying and 3 paise for selling against USD, closing at 281.41 and 282.90, respectively.

Against Euro, the PKR lost 26 paise for buying and 72 paise for selling, closing at 319.58 and 322.63, respectively.

Against UAE Dirham, the PKR gained 12 paise for buying and 11 paise for selling, closing at 76.47 and 77.09, respectively.

Against Saudi Riyal, the PKR lost 13 paise for buying and 6 paise for selling, closing at 75.11 and 75.69, respectively.

Open-market rates for dollar on Wednesday

BID Rs 281.41

OFFER Rs 282.90