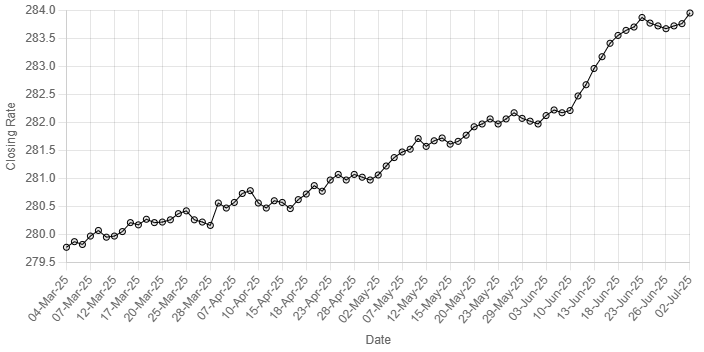

Rupee’s Performance Against US Dollar Since 04 March 2025

const ctx = document.getElementById(‘closingRatesChart’).getContext(‘2d’);

const closingRatesChart = new Chart(ctx, {

type: ‘line’,

data: {

labels: [

“04-Mar-25”, “05-Mar-25”, “06-Mar-25”, “07-Mar-25”, “10-Mar-25”, “11-Mar-25”, “12-Mar-25”,

“13-Mar-25”, “14-Mar-25”, “17-Mar-25”, “18-Mar-25”, “19-Mar-25”, “20-Mar-25”, “21-Mar-25”, “24-Mar-25”,

“25-Mar-25”, “26-Mar-25”, “27-Mar-25”, “28-Mar-25”, “03-Apr-25”, “04-Apr-25”, “07-Apr-25”, “08-Apr-25”, “09-Apr-25”, “10-Apr-25”, “11-Apr-25”, “14-Apr-25”, “15-Apr-25”, “16-Apr-25”, “17-Apr-25”, “18-Apr-25”, “21-Apr-25”, “22-Apr-25”, “23-Apr-25”, “24-Apr-25”, “25-Apr-25”, “28-Apr-25”, “29-Apr-25”, “30-Apr-25”, “02-May-25”, “05-May-25”, “06-May-25”, “07-May-25”, “08-May-25”, “09-May-25”, “12-May-25”, “13-May-25”, “14-May-25”, “15-May-25”, “16-May-25”, “19-May-25”, “20-May-25”, “21-May-25”, “22-May-25”, “23-May-25”, “26-May-25”, “27-May-25”, “29-May-25”, “30-May-25”, “02-Jun-25”, “03-Jun-25”, “04-Jun-25”, “05-Jun-25”, “10-Jun-25”, “11-Jun-25”, “12-Jun-25”, “13-Jun-25”, “16-Jun-25”, “17-Jun-25”, “18-Jun-25”, “19-Jun-25”, “20-Jun-25”, “23-Jun-25”, “24-Jun-25”, “25-Jun-25”, “26-Jun-25”, “27-Jun-25”, “30-Jun-25”, “02-Jul-25”

],

datasets: [{

label: ‘Closing Rates’,

data: [

279.77, 279.87, 279.82, 279.97, 280.07, 279.95, 279.97, 280.05, 280.21, 280.17, 280.27, 280.21, 280.22, 280.26, 280.37, 280.42, 280.26, 280.22, 280.16, 280.56, 280.47, 280.57, 280.73, 280.78, 280.56, 280.47, 280.60, 280.57, 280.46, 280.62, 280.72, 280.87, 280.77, 280.97, 281.07, 280.97, 281.07, 281.02, 280.97, 281.06, 281.22, 281.37, 281.47, 281.52, 281.71, 281.57, 281.67, 281.72, 281.61, 281.66, 281.77, 281.92, 281.97, 282.06, 281.97, 282.06, 282.17, 282.07, 282.02, 281.97, 282.12, 282.22, 282.17, 282.21, 282.47, 282.67, 282.96, 283.17, 283.41, 283.55, 283.64, 283.70, 283.87, 283.77, 283.72, 283.67, 283.72, 283.76, 283.95

],

borderColor: ‘black’,

borderWidth: 1,

fill: false,

pointRadius: 3

}]

},

options: {

responsive: true,

plugins: {

legend: {

display: false

}

},

scales: {

x: {

title: {

display: true,

text: ‘Date’

}

},

y: {

title: {

display: true,

text: ‘Closing Rate’

}

}

}

}

});

The Pakistani rupee posted marginal decline against the US dollar, depreciating 0.07% in the interbank market on Wednesday.

At close, the currency settled at 283.95, a loss of Re0.19 against the previous close.

On Monday, the currency settled at 283.76.

The interbank market was closed on Tuesday on account of a bank holiday.

Globally, the US dollar hunkered near the lowest since February 2022 against major peers on Wednesday, as traders considered dovish hints from Federal Reserve Chair Jerome Powell, along with the potential impact of President Donald Trump’s spending bill.

The greenback was pinned near its weakest since September 2021 on the euro, and was at its lowest since January 2015 versus the Swiss franc.

Powell reiterated on Tuesday at the European Central Bank’s annual conference in Sintra, Portugal that the Fed is taking a patient approach to further interest rate cuts, but didn’t rule out a reduction at this month’s meeting, saying everything depends on incoming data.

That raises the stakes for the monthly non-farm payrolls report on Thursday.

Indications of labour market resilience in the US JOLTS figures overnight saw the dollar rise off Tuesday’s lows.

The US dollar index, which measures the currency against six major counterparts, edged up slightly to 96.677, but didn’t stray far from the overnight low of 96.373.

Markets are also keeping a close watch on Trump’s massive tax-and-spending bill, which could add $3.3 trillion to the national debt.

The bill, which was passed by the US Senate, will return to the House for final approval.

Oil prices, a key indicator of currency parity, edged up on Wednesday as Iran suspended cooperation with the U.N. nuclear watchdog and markets weighed expectations of more supply from major producers next month while the U.S. dollar softened further.

Brent crude added 92 cents, or 1.4%, to $68.03 a barrel at 1125 GMT, while U.S. West Texas Intermediate crude rose 89 cents, or 1.4%, to $66.34 a barrel.

Brent has traded between a high of $69.05 a barrel and low of $66.34 since June 25, as concerns of supply disruptions in the Middle East producing region have ebbed following the ceasefire between Iran and Israel.

Inter-bank market rates for dollar on Wednesday

BID Rs 283.95

OFFER Rs 284.15

Open-market movement

In the open market, the PKR lost 23 paise for buying and 25 paise for selling against USD, closing at 285.07 and 286.39, respectively.

Against Euro, the PKR lost 8 paise for buying and gained 38 paise for selling, closing at 335.78 and 338.53, respectively.

Against UAE Dirham, the PKR remained unchanged for both buying and selling, closing at 77.65 and 78.10, respectively.

Against Saudi Riyal, the PKR lost 7 paise for buying and remained unchanged for selling, closing at 75.98 and 76.40, respectively.

Open-market rates for dollar on Wednesday

BID Rs 285.07

OFFER Rs 286.39